For most blockspace users, gas prices are more than just a fee—they’re a gatekeeper. And beyond that, most users don’t even know how much they’re constrained by this invisible gate.

While crypto discussions often focus on protocol design, new chains, and token mechanics, the cost of transacting—especially on Ethereum and its Layer-2s—remains a powerful force shaping user behavior, transaction throughput, and ultimately, Total Value Locked (TVL).

Gas Fees: The Invisible Gatekeeper

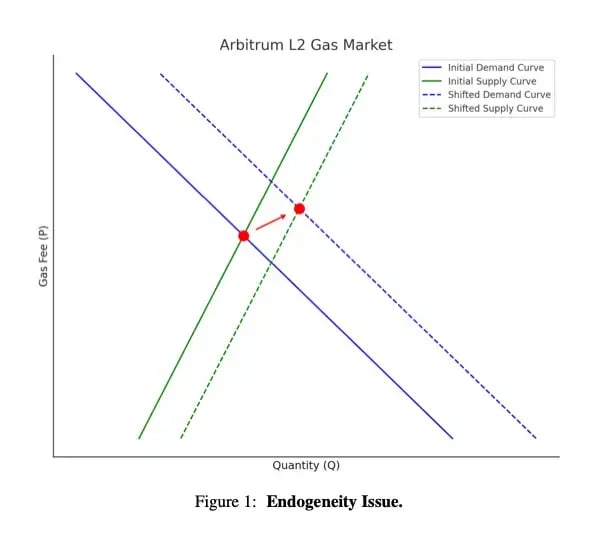

Gas prices don’t cause transaction demand—they constrain it.

Academic research suggests that onchain transaction demand exhibits a price elasticity of approximately -1.11. In economic terms, that means for every 1% reduction in the cost of executing a transaction, we can expect roughly a 1.11% increase in demand.

That might sound incremental—until you scale it across an entire ecosystem.

A conservative 20% improvement in gas price efficiency translates to a projected 22% increase in baseline transaction volume. That’s not a one-off spike—that’s compounding, systemic throughput improvement.

The Hidden Cost of Overestimation

Today’s default RPC providers often misestimate gas fees—sometimes drastically. On several prominent Layer-2 networks, we’ve observed default RPCs overestimating gas by more than 10x. These inefficiencies not only hurt users; they leave real value on the table for networks, protocols, and apps.

Gas mispricing makes some transactions non-viable, suppressing volume and making L2s less active and less efficient than they truly are.

The Zone of Transaction Uncertainty

End users are likely not staring at gas charts, waiting to submit transactions when fees drop. But for automated trading systems - bots, solvers, etc. - there is a narrow band where expected profit from a prospective transaction hovers just above break-even but hasn’t cleared the threshold of risk-adjusted certainty.

When gas prices on blockchain networks bounce around unpredictably, it's hard for traders to know exactly what a transaction will cost. Even small changes in fees can determine whether a trade makes money or loses it, or whether it happens at all.

Networks that provide more stable and predictable fees make life easier for everyone. With less uncertainty about costs, more trades become viable - transactions that traders might have avoided before can now proceed with confidence.

The bottom line: Better fee prediction means fewer missed opportunities. This benefits both automated trading systems and the overall network by increasing activity and liquidity.

What Happens with More Accurate Gas?

Let’s run the numbers.

Assuming that ~20% efficiency improvement is achieved across the board, over a three-year horizon, the Ethereum ecosystem could see:

-

200+ million additional L1 transactions

-

1.25+ billion additional L2 transactions

That’s not just volume—it’s revenue, liquidity, protocol activity, and growth in TVL. Every transaction represents potential DeFi activity, a user action, or a smart contract interaction that otherwise wouldn’t have happened.

Why This Matters

This isn’t about just making Ethereum “cheaper.” It’s about unlocking latent demand.

During periods of high gas fees, efficient pricing ensures that more transactions remain economically viable. During low-congestion times, it ensures throughput stays consistent and affordable—fueling everything from DeFi strategies to NFT minting to autonomous agent operations.

The result? A healthier, more active onchain economy.

A Call to Action

It’s time to take gas pricing seriously.

Web3 won’t reach its full potential until pricing infrastructure becomes as performant and reliable as the smart contracts it supports. If we want to see higher TVL, more cross-chain interoperability, and more real-world utility, we need to start at the base layer: the gas.

Because when gas becomes efficient, so much else becomes possible. When gas markets become more efficient, every other layer of the stack does too.

Ready to take control of your gas fees? Getting started with Gas Network is easy:

-

Explore the Docs: Check out our developer documentation to learn how to integrate our feeds into your smart contracts.

-

Try Our Extension: Download our Chrome extension for an easy, user-friendly way to monitor and manage gas prices.

-

Stay Connected: Follow us on X for product updates, behind-the-scenes insights, and important announcements.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension