How the London Hard Fork Has Impacted Ethereum Gas Fee Volatility

tl;dr: the new Type 2 parameters should smooth out gas prices and lead to shorter wait times in the mempool.

Ethereum transaction fees can be extremely volatile. Senders might have to wait long periods of time for a transaction to become finalized on-chain. Those precious few seconds/minutes could be the difference in turning a trader into a DeFi genius or a bagholder. EIP-1559 was launched on August 5th, 2021 to alleviate some of the pain points associated with gas instability. This post will explore:

- The current state of the Ethereum network

- How centralized exchanges and mining pools are adjusting

- How EIP-1559 empirically impacts performance

A Quick Refresher on EIP-1559

Prior to EIP-1559, gas was determined through a simple auction mechanic. Transactions that offered the highest gas prices would get on-chain the fastest. But DeFi moves quickly. Hot arbitrage plays and NFT drops can cause massive spikes in gas prices as people/bots fight to get on-chain the fastest. Meanwhile, transactions with gas prices that would have been competitive under more stable circumstances are left waiting while miners are drawn to juicier transaction fees.

EIP-1559 introduced a new transaction category (Type 2) to improve gas instability. If you'd like to read about it a bit more, we suggest you take a look at one of our previous blog posts that goes deeper into the terminology used in this piece, particularly Base Fee, Max Priority Fee, and Max Fee Per Gas. The Max Priority Fee, known as the miners' tip, is optional, determined by the user, and is paid directly to miners.

The State of the Ethereum Network

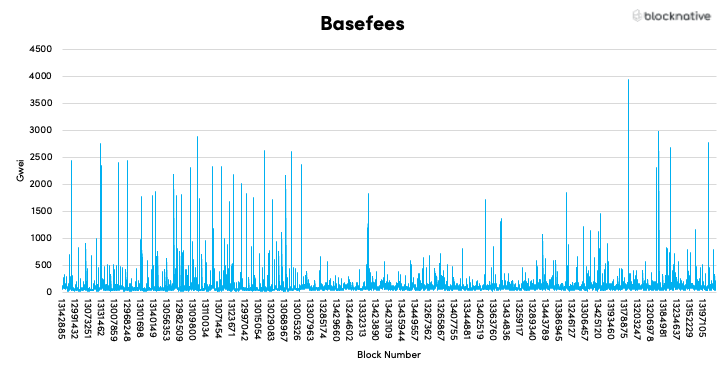

At the time of this writing, EIP-1559 has been live for 75 days (487,068 blocks). Base Fees fluctuated quite a bit, starting at 1 Gwei in block 12965000, rising as high as 3941.92 Gwei during block 13180436 on the evening of September 7th1.

Here are all of the Base Fee's to date:

Source: Blocknative Mempool Data Archive

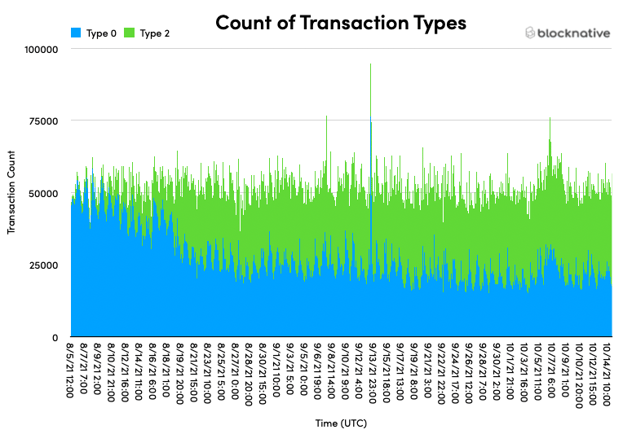

Type 2 transactions have oscillated between about 40% and 60% of all Ethereum traffic on an hourly basis:

Case Study - Centralized Exchanges and Mining Pools

Utilizing Etherscan’s label cloud, we collected wallet addresses from a few key entities in the ecosystem. Upon analyzing their activity, we found some interesting phenomena:

- Centralized Exchanges are slow to adopt Type 2 transactions

- Mining Pools were among the first to adopt Type 2 transactions

CENTRALIZED EXCHANGES (CEXs)

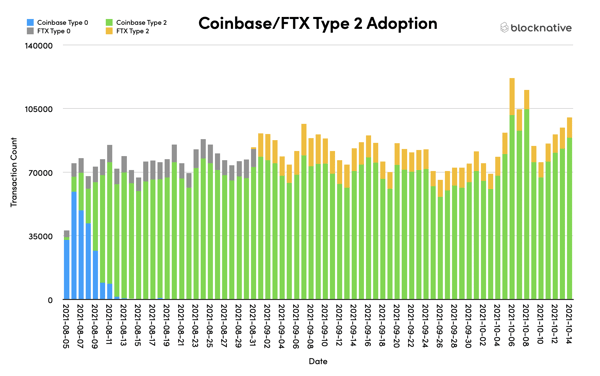

Despite being over two months after London hard fork, the vast majority of CEXs we examined still utilize Type 0 transactions2. Of the wallet addresses in our sample, we found that only Coinbase and FTX have adopted using Type 2 transactions (around August 12th and August 31st respectively):

Coinbase reported a savings of 9% on effective gas prices and an improvement of broadcast-to-confirmation time by 11 seconds.

In our sample, high-volume exchanges like Binance, Gemini, and Kraken are still using Type 0 legacy transactions! This was surprising, given the apparent technical advantages and the engineering resources that some of these larger CEXs have at their discretion.

MINING POOLS

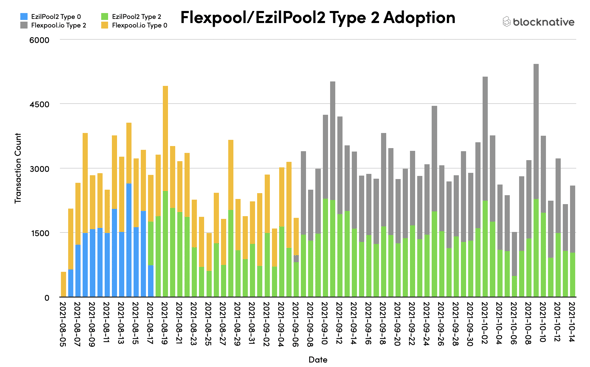

Mining pools in our sample have been very quick to adopt Type 2 transactions to pay out their pool participants. They have likely transitioned to Type 2 in order to minimize their gas price to the Base Fee, considering they possess the hashing power to mine their own transactions.

While some of the larger mining pools (like Ethermine) quickly started making payments with Type 2 transactions, a few smaller pools didn’t make the switch until much later:

However, some mining pools, like Hiveon, still appear to be using Type 0 transactions.

Transaction Performance

Did EIP-1559 successfully improve gas prices/time to confirmation across the network? Let's take a look:

METHODOLOGY

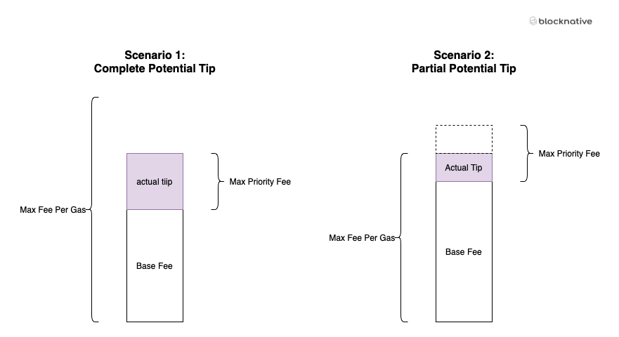

In order to compare apples to apples, we had to convert Type 2 gas prices to legacy gas prices. First, using the Base Fee, Max Priority Fee, and Max Fee Per Gas fields, we were able to calculate the actual tip paid to miners:

Once we have the actual tip for each transaction, we can calculate the effective gas price by adding the actual tip to the Base Fee.

EFFECTIVE GAS PRICE

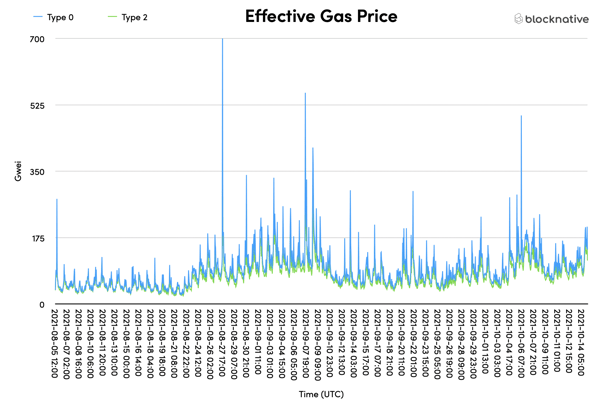

When we compare the hourly median effective gas prices for Type 0 and Type 2 transactions, we find the following:

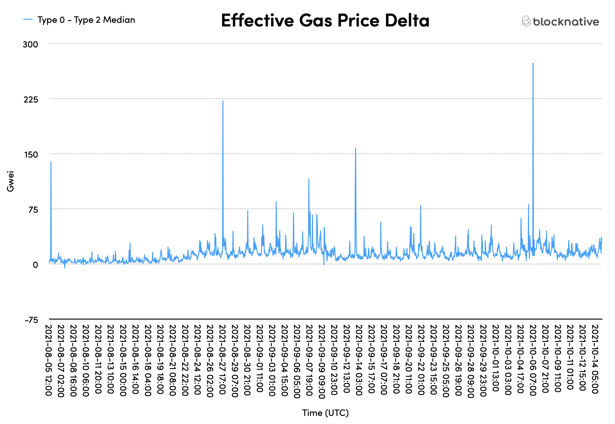

In this visualization, Type 0 transactions pay slightly more in gas than Type 2 transactions to get on-chain. To better visualize the effectiveness of EIP-1559 on gas prices, we plotted the delta between the hourly median gas prices of Type 0 and Type 2 transactions by subtracting the two from each other:

Positive values in the above chart indicate that during the hourly slice, effective gas prices were higher for Type 0 transactions. On the average hour, this was a cost savings of roughly 12.33 Gwei!

TIME PENDING

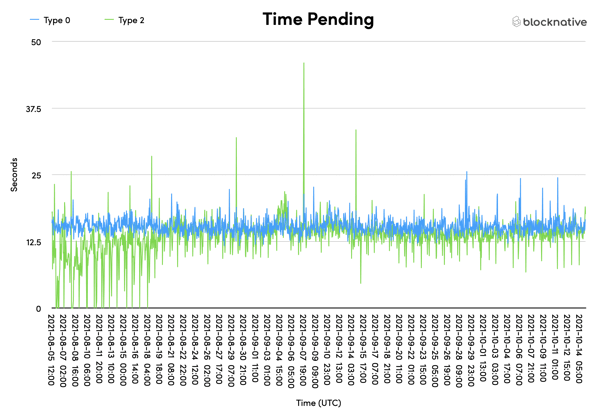

Finally, using our mempool archive, we calculated how long it took to get on-chain, from first appearing in the mempool to first being confirmed or failed. Here are the median time-pending’s:

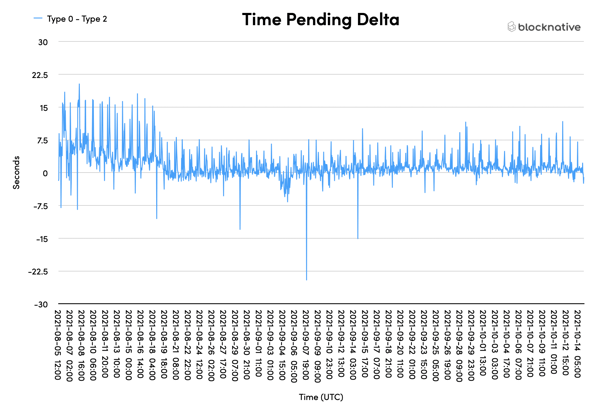

Despite having a few spikes, Type 2 transactions seem to get on-chain quicker. Things become a bit more clear when we visualize the hour-by-hour deltas between median time-pending’s:

Positive values indicate that Type 0s waited longer to get on-chain compared to Type 2 transactions. On average, Type 2s senders saw transactions on-chain 1.1 seconds faster than their respective Type 0 counterparts.

Takeaway - Type 2 transactions pay less in gas AND get on-chain faster!

Summary

Although Type 2 transactions are a more cost-efficient and faster way to make ETH transactions, about half of transactions are still legacy Type 0. Whichever transaction Type you choose to make, Blocknative can assist you and your needs. Our Gas Platform API and Gas Estimator Browser Extension can estimate the right Max Priority Fee and Max Fee Per Gas so your transaction can get on-chain quickly without overpaying in gas. And it’s also backward compatible for Type 0 transactions.

What are your thoughts on EIP-1559? What kind of things would you like us to investigate? Join the Blocknative community on Discord if you’d like to join the conversation!

Footnotes

1 - This spike was caused by The Sevens NFT drop. In this block, Base Fees totaling 13.1 ETH were burnt, valued roughly at $45,000.

2 - Binance, Kucoin, Gate.io, Huobi, FTX, Gemini, Okex, Coinbase, kraken

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension

.png)