When Ethereum upgraded its core gas-fee marketplace with EIP-1559, transactions moved from a first-price auction to a hybrid system involving base fees and tips. As we have previously covered, this introduced new levels of complexity for transacting on-chain.

To help further clarify this, today we will explain the new terms and how to approach the core variables associated with EIP-1559 transaction fees.

The New Terminology of EIP-1559 Transactions

First, a refresher: EIP-1559 changed how Ethereum transaction fees are calculated and where those fees go. Instead of a singular Gas Price, you now have to pay attention to three separate values:

- The

Base Fee, which is determined by the network itself and is subsequently burned. - A

Max Priority Fee, which is optional, determined by the user, and is paid directly to miners. - The

Max Fee Per Gas, which is the absolute maximum you are willing to pay per unit of gas to get your transaction included in a block. For brevity and clarity, we will refer to this as theMax Fee.

Transactions that include these new fields are known as Type 2, while legacy transactions that carry the original Gas Price field remain supported and are known as Type 0. Note: EIP-1559 does not bring changes to the Gas Limit, the maximum amount of gas the transaction is authorized to consume.

Determining the Base Fee

The Base Fee is determined by the Ethereum network rather than being set by end-users looking to transact or miners seeking to validate transactions. The Base Fee targets 50% full blocks and is based upon the contents of the most recent confirmed block. Depending on how full that new block is, the Base Fee is automatically increased or decreased.

For example:

- If the last block was exactly 50% full, the

Base Feewill remain unchanged. - If the last block was 100% full, the

Base Feewill increase by the maximum 12.5% for the next block. - If the last block was more than 50% full but less than 100% full, the

Base Feewill increase by less than 12.5%. - If the last block was 0% full – that is, empty – the

Base Feewill decrease the maximum 12.5% for the next block. - If the last block was more than 0% full but less than 50% full, the

Base Feewill decrease by less than 12.5%.

This new mechanism is meant to help smooth transaction fees and prevent sudden spikes. The most important thing to keep in mind when it comes to the Base Fee: it is 100% automatic and readable directly from the network.

Setting a Priority Fee

The Max Priority Fee — also often referred to as the miner tip — is an 'optional' additional fee that is paid directly to miners in order to incentivize them to include your transaction in a block. While the Max Priority Fee is technically optional, at the moment most network participants estimate that transactions generally require a minimum 2.0 GWEI tip to be candidates for inclusion. With that said, specific mining pools may choose to set alternative minimums for inclusion.

For 'typical' transactions that are submitted under normal, not-congested network conditions, the Max Priority Fee will need to be close to 2.0 GWEI. But, for transactions where order or inclusion in the next block is important, or when the network is highly congested, a higher Max Priority Fee may be necessary to prioritize your transaction.

A somewhat subtle nuance to the Max Priority Fee is that it represents the maximum tip you are willing to pay to a miner. However, if the Base Fee plus the Max Priority Fee exceeds the Max Fee (see below), the Max Priority Fee will be reduced in order to maintain the upper bound of the Max Fee. This means the actual tip may need to be smaller than your Max Priority Fee and, under such circumstances, your transaction may become less attractive to miners.

Calculating the Max Fee

Now that we have covered the basics of the Base Fee and the Max Priority Fee, we can tackle the somewhat counterintuitive notion of the Max Fee.

The Max Fee is the absolute maximum amount you are willing to pay per unit of gas to get your transaction confirmed. And here is where things can get a little confusing – given that, under most circumstances, your actual transaction fee will be less than the Max Fee you specify up front. Here is why:

- The minimum gas price for your transactions is the current

Base Fee. - However, what if the

Base Feeincreases while your transaction is pending? Your transaction will become underpriced and be at risk of becoming stuck. Or failing. Or getting dropped. This is undesirable for all of the reasons you might expect. - Hence, for predictable transaction settlement under EIP-1559, it is currently considered best practice to set a

Max Feethat anticipates such an increase in theBase Fee. But by how much? And why? - Our EIP-1559-compliant ETH gas fee estimator currently uses the following simple heuristic to calculate the recommended

Max Feefor any givenBase FeeandMax Priority Feecombination: Max Fee= (2 *Base Fee) +Max Priority Fee

Doubling the Base Fee when calculating the Max Fee ensures that your transaction will remain marketable for six consecutive 100% full blocks. The table below illustrates why.

An Illustrative Example: From Marketable to Unmarketable in Six Blocks

Assume your transaction is submitted during Block 1, when the Base Fee is 100.0 GWEI. You choose to set a Max Priority Fee of 2.0 GWEI, so your Max Fee calculation is (2 * 100.0 + 2.0) or 202.0 GWEI.

But, just as you are submitting your transaction, a high profile NFT drop happens and network demand surges. Suddenly, every block is 100% full – rather than the 50% target discussed above – so the Base Fee increases by the maximum 12.5% per block.

Thus:

| Block | Base Fee | % Full | Increase in Base Fee | Priority Fee specified | Max Fee specified | Gas Price Paid if confirmed | Gas 'Saved' |

| 1 | 100.0 GWEI | 100% | 12.5% | 2.0 | 202.0 | 102.0 | 100.0 |

| 2 | 112.5 GWEI | 100% | 12.5% | 2.0 | 202.0 | 114.5 | 87.5 |

| 3 | 126.6 GWEI | 100% | 12.5% | 2.0 | 202.0 | 128.6 | 73.4 |

| 4 | 142.4 GWEI | 100% | 12.5% | 2.0 | 202.0 | 144.4 | 57.6 |

| 5 | 160.2 GWEI | 100% | 12.5% | 2.0 | 202.0 | 162.2 | 39.8 |

| 6 | 180.2 GWEI | 100% | 12.5% | 2.0 | 202.0 | 182.2 | 19.8 |

| 7 | 202.7 GWEI | - | - | 2.0 | 202.0 | Ineligible | -0.7 |

As you can see, it takes six consecutive 100% full blocks for the Base Fee to double – in this case, from 100.0 GWEI to 202.7 GWEI.

Practically speaking, by setting your Max Fee in this manner, your transaction is 'protected' against becoming underpriced and hence unmarketable in the event of the most rapid escalation of the Base Fee possible.

But what if the Base Fee does not increase so rapidly? You will be charged less than the Max Fee you specified. To see why, refer to the table above:

- Remember, your transaction was submitted during Block 1, when the

Base Feewas 100.0 GWEI. You chose to set aMax Priority Feeof 2.0 GWEI, so yourMax Feecalculation was 202.0 GWEI. - Your transaction is

Confirmedduring Block 4, when theBase Feeis 142.2 GWEI. - Your transaction fee is determined by the price of the

Base Feewhen confirmed plus yourMax Priority Fee. So you will pay 144.2 GWEI per gas for the transaction. - This is 57.6 GWEI per gas less than the

Max Feeyou specified. That 57.6 GWEI per gas is effectively 'saved' and will remain in your wallet. - It is worth noting that your

Max Feeis not 'withdrawn' from your wallet and then some portion is 'refunded'. Instead, imagine that theMax Feeis the 'maximum authorized charge' threshold. - If your transaction was not confirmed before Block 6, it would become unmarketable – and no longer a candidate for inclusion – during Block 7 since its

Max Feeof 202.0 GWEI falls just below the newBase Feeof 202.7 GWEI.

Finally, in the scenario above, what if you failed to include the 2x safety factor in your Max Fee calculation and instead set the Max Fee to the minimum of 102.0 GWEI?

- Your transaction would be marketable during Block 1 since your

Max Feeis still above theBase Feeof 100.0 GWEI. - However, by Block 2 your transaction would become underpriced because its

Max Feefalls below the newBase Feeof 112.5 GWEI. - Your transaction would remain

Pendinguntil theBase Feedecreases and falls below itsMax Feeof 102.0 GWEI. - Or, if the network is highly congested, your transaction might get dropped altogether.

And this is why the Max Fee is counterintuitive:

- Most of the time – and likely the vast majority of the time – you will pay less in transaction fees than your

Max Fee. - But sometimes, particularly during periods of high network congestion, you will be charged your

Max Fee. - If you roll the dice and set your

Max Feetoo close to the currentBase Fee, you run the risk of your transaction becoming underpriced and hence no longer eligible for inclusion.

For predictable transaction settlement performance, we recommend incorporating a healthy safety factor in your Max Fee calculations.

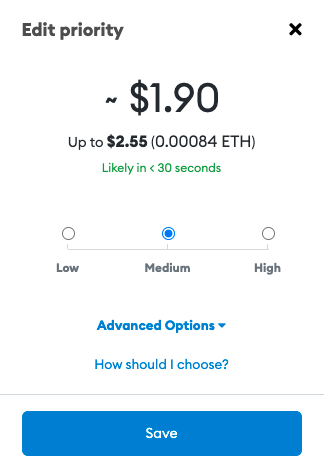

EIP-1559 in MetaMask

By default, version 10.0.0 of MetaMask will automatically set your transaction's Max Priority Fee. You can override these with the EDIT button, which will allow you to select low (slowest to confirm), medium, or high (fastest to confirm) fees:

To manually specify your transaction's Gas Limit, Max Priority Fee, and Max Fee, select the Advanced Options drop down. -png.png)

Blocknative Helps You Set EIP-1559 Transaction Fees with Confidence

Blocknative is here to help with our world-class mempool monitoring capabilities. Our ETH gas fee estimator and ETH Gas Extension – which is powered by our industry-leading ETH Gas Platform API– fully supports EIP-1559. Gas Platform inspects every pending Ethereum transaction to help you accurately estimate transaction fees to get included in the next block.

Please stay tuned for updates as we expand and refine our support for EIP-1559 across our portfolio, including enhancements to how best to calculate your Max Fee.

Are there other aspects of EIP-1559 you would like us to cover? Or is this post missing specific ETH gas information? Please join our Discord Community if you have questions, concerns, or recommendations.

Learn more about future upgrades to ETH via our Guide to The Ethereum Merge.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension