DeFi is a blockchain term that refers to decentralized finance, and the ethos of the term refers to the creation of an open financial system that doesn’t rely on authorities or intermediaries. Today most DeFi activity is on the Ethereum network and ranges from digital assets to financial smart contracts to protocols.

With DeFi, developers can program applications that can store, lend, borrow, or otherwise manage digital assets. These applications often come to life in the form of smart contracts or protocols — which can be leveraged by other developers to build on.

Today we will explore this emerging world that seeks to reinvent the financial system.

Popular DeFi Projects

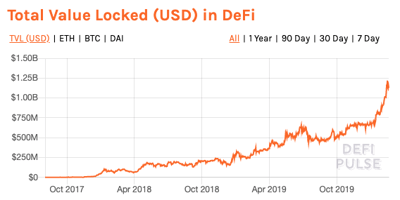

The DeFi landscape is just a few years old, but there are dozens of different companies building technology in the space. In 2019 we saw a growth of assets into DeFi, ending the year with over $650 million in assets.

Assets in DeFi from DeFi Pulse

To help you understand the potentials of DeFi, we wanted to explore some of the leading protocols:

- MakerDAO — A decentralized credit platform that enables users to lock assets (such as ETH) into a debt contract and take out a stablecoin, Dai, that targets a value of $1 USD.

- Compound — A permissionless money market protocol on that lets users earn interest or borrow assets. Lenders can supply assets and earn continuously-compounding interest. Rates are algorithmically adjusted based on supply and demand.

- Uniswap — A smart-contract based exchange that uses liquidity pools to let users swap ETH or any ERC-20 token.

- dYdX — A non-custodial trading platform that serves experienced traders.

- Kyber — An on-chain liquidity protocol that enables secure token exchanges.

- Oasis — A platform to trade, borrow, or lend Dai.

These are just a handful of the DeFi protocols that are available to users today. And many DeFi participants spend time managing assets across many of these popular tools and services.

Consolidating The Emerging DeFi Landscape

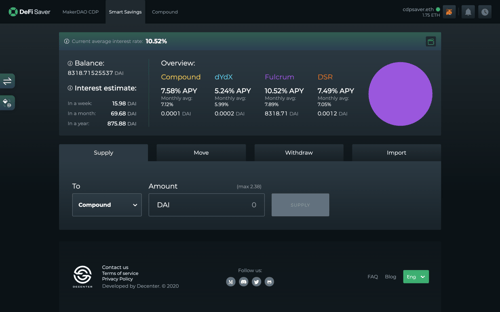

DeFi Saver is a one-stop-shop for users who want to manage assets across multiple protocols. They provide easy to use dashboards for MakerDAO and Compound. And they have a specialized Dai lending dashboard called Smart Savings, which connects users to several protocols — Compound, dYdX, Fulcrum, and Maker. This provides users with a less fragmented, more uniform experience, while also providing unique tools to manage DeFi assets.

The team's main focus has been on MakerDAO. One unique feature of Maker's platform is that there exists a minimum collateralization ratio — if your positions collateralization ratio drops below it due to price drops (in ETH or BAT), your collateral gets liquidated and used to pay back the debt created in the protocol.

DeFi Saver aims to fix this with their CDP Automation — a smart-contract based system for automated ratio management. This functionality effectively provides users with automatic liquidation protection, as well as automatic leverage increase, since MakerDAO is often used as a way to leverage ETH.

Increasing leverage of a Maker Collateralized Debt Position on DeFi Saver

Increasing leverage of a Maker Collateralized Debt Position on DeFi Saver

The CDP Automation tool currently manages over 75,000 ETH in over 200 different positions. It has become an important tool for many participants in the DeFi ecosystem.

Compound is the other major protocol supported by DeFi Saver. Their Compound dashboard enables users to manage their loans and deposits in the Compound ecosystem easily. And with DeFi Saver’s Smart Savings option, lenders can quickly find the best interest rates across multiple Dai lending options in decentralized finance, as shown in the screenshot below.

Easily Browse Rates Across Multiple Protocols

Easily Browse Rates Across Multiple Protocols

If you're looking to explore the world of decentralized finance, DeFi Saver is one option that helps to reduce the complexity of managing assets across multiple platforms.

Leveraging The Mempool To Improve User Experience

DeFi Saver realized that the gap from when a user submitted a transaction until it was confirmed on-chain created end-user anxiety. In the best case, there was no feedback until a transaction was confirmed on a block. In the worst case, if a user refreshed the page or had to issue a speed up or cancel transaction due to miscalculating ETH gas, then the DeFi Saver dashboard would lose track of the transaction.

While the team behind DeFi Savers are experienced devs, this was not a problem they could solve unless they built and maintained their own infrastructure of mempool nodes. According to Nikola Jankovic, DeFi Saver's community manager,

The complexity of the mempool is too great for any team to handle on its own. I was excited to find Blocknative’s Notify API — which easily enables me to track transactions as they move through the mempool and keep end-users in the loop at every stage.

With Notify, DeFi Saver is able to keep users alerted about their transaction status as it moves through the mempool directly via their web3 wallet. And the API also enables DeFi Saver to match up changing transaction hashes if a user issues a speed up or cancel transaction. This real-time notification infrastructure increases end-user engagement and helps to reduce anxiety around transacting. According to Nikola, “we’ve received a lot of positive feedback from our users after deploying transaction notifications. We initially thought they’d only be useful to new users, but many whales and experienced traders have told us how useful they find the alerts.”

For users who are looking to explore the world of DeFi, platforms like DeFi Saver provide an easy way to get started. They consolidate the myriad of DeFi offerings into one easy-to-use platform. And with Blocknative, DeFi Saver is able to reduce anxiety by providing real-time updates on transaction status. Those insights increase confidence and provide a safer environment for new users to navigate this new world.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension