The Ethereum Merge is complete. It ushered in the era of Proof-of-Stake, laid the foundation for a more decentralized network, and introduced exciting new actors to the consensus mechanism like block builders and MEV relayers.

Something it didn't do? Lower gas fees. At least not directly. But it did set the stage for something bigger.

It's no secret that gas fees have been a UX issue for Ethereum. The surge of DeFi and NFT activity on the network since 2020 has resulted in immense transaction volume increases. During times of peak usage, this clogs the network and drives fees higher.

With this background, it’s understandable why many users hoped that The Merge would bring relief. And the good news is that it did lay the groundwork for future gas fee optimizations. In this article, we'll look at what Ethereum gas is, what The Merge did, why it didn't lower gas fees, and highlight the improvements it brought to the table in terms of future scalability.

Why Ethereum Gas Fees Are So High

For those who don't know, every transaction on the Ethereum network costs the user a certain amount of gas. "Gas" is essentially a unit of measure used to calculate the fees for including a transaction in the “blocks” that make up the ETH blockchain.

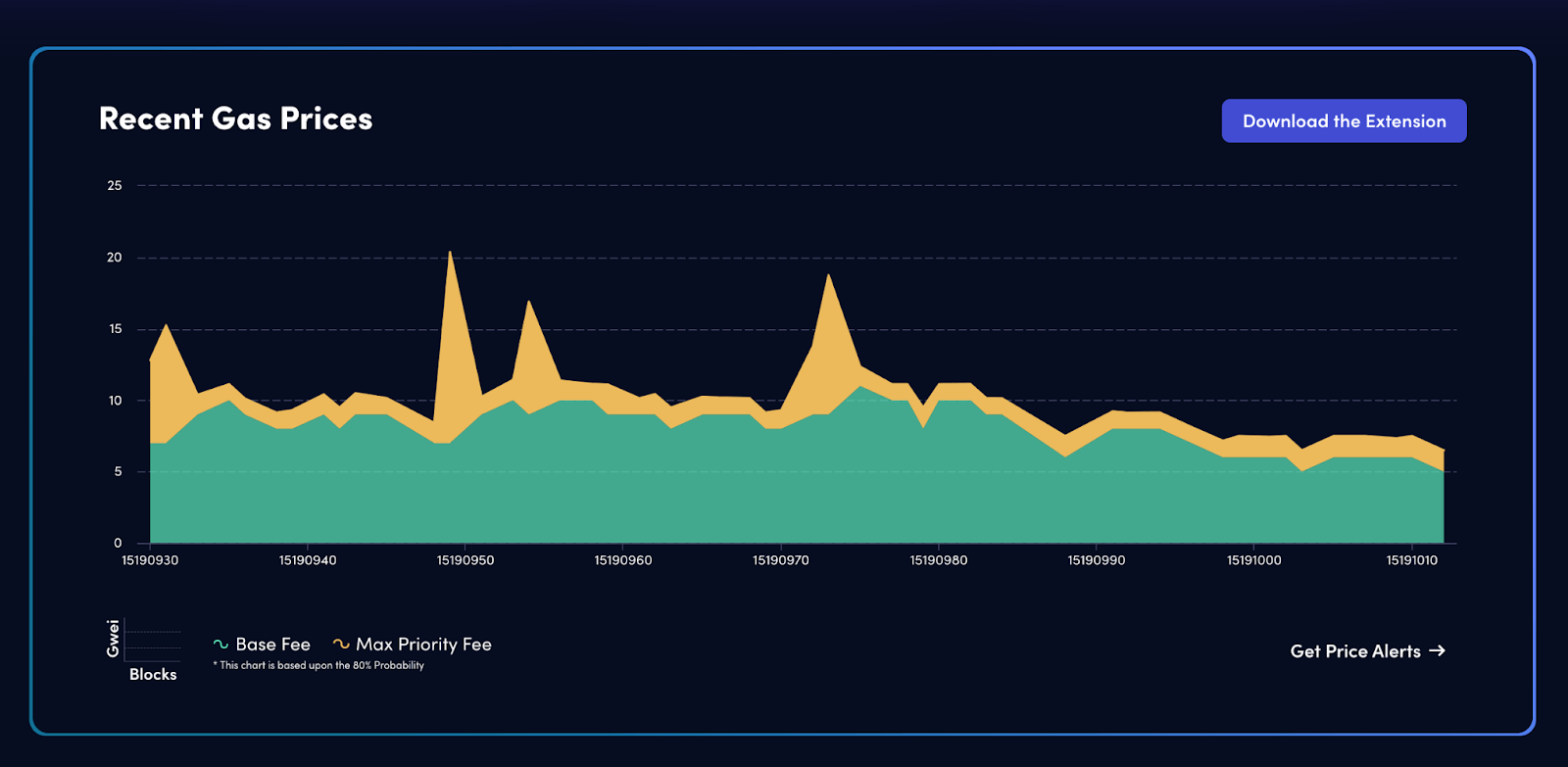

In the illustration below, you'll see a graph containing recent gas prices relative to the blocks created:

Source: Blocknative Gas Estimator

In August 2021, Ethereum launched a new fee model called "EIP-1559", changing fee calculation. Under EIP-1559, every transaction has a base fee based on the current demand for block space, plus a transaction "tip" value (priority fee) paid to network actors that confirm block validity.

There is a good amount of complexity that goes into calculating ETH gas prices for any given block and we recommend reading our ETH Gas 101 Guide to learn more. For the sake of this blog though, the important thing to remember is this: Gas fees are not inconsequential to participating on-chain and they vary based on the demand for block space.

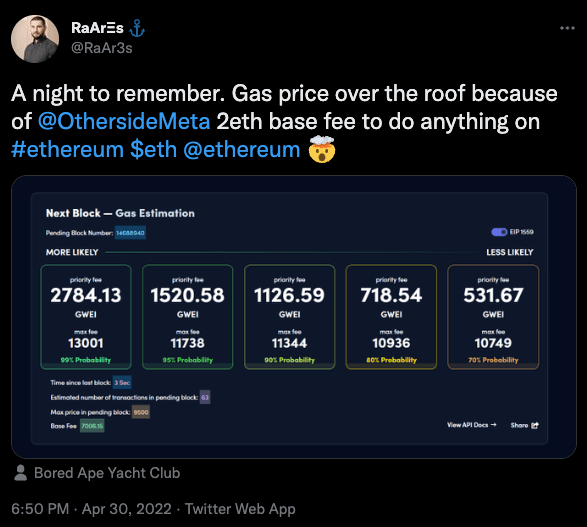

During times of network congestion, they can become extremely expensive:

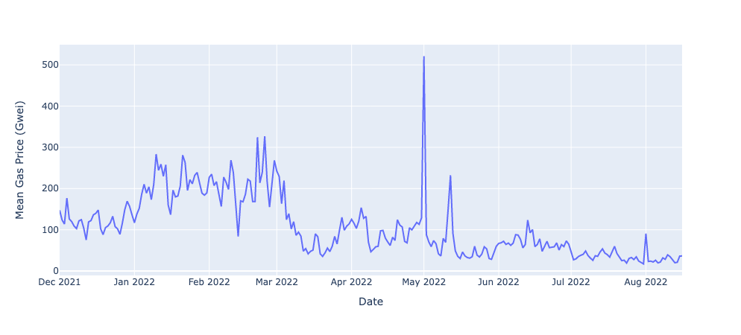

And even though gas fees are now generally low, they have experienced consistently elevated levels in the past. For most of January 2022 gas fees averaged over 150 gwei per block, roughly 10x average prices today.

Data via Blocknative

Data via Blocknative

This is why the assumption that The Merge would lower gas fees was so common. The Merge was a huge upgrade, and elevated gas prices are an inconvenient reality of participating on Ethereum. So how did The Merge take steps to address this problem? Let’s cover that below.

ETH Gas Fees After The Merge

The Merge did not lower gas fees directly. There was nothing built into the technical upgrades of The Merge that would specifically lower fees. However, what it did accomplish was to create the technical environment necessary for future gas optimizations.

Activating PoS was the first step toward enabling sharding. This upgrade will allow the network to be split into “shard chains” that share the load of Ethereum, theoretically reducing congestion and increasing transaction throughput. Sharding is planned to begin in 2023 and should enable giant leaps in scalability for the network.

Once implemented, sharding could theoretically increase Ethereum’s transaction throughput up to 100,000 transactions per second—higher throughput than all leading credit card companies.

Sharding will work in conjunction with Ethereum’s “rollup centric” roadmap. The Ethereum Foundation states that “given the rise and success of layer 2 technologies to scale transaction execution, sharding plans have shifted to finding the most optimal way to distribute the burden of storing compressed calldata from rollup contracts, allowing for exponential growth in network capacity.”

These innovations enabling thriving layer 2 ecosystems will be what fundamentally lowers gas fees for normal users of Ethereum. The layer 1 chain will be able to focus on decentralization, while layer 2 chains will allow users to take advantage of base layer security with minimal transaction fees.

Prioritizing Gas in Ethereum's Future Roadmap

On July 21, Ethereum co-founder Vitalik Buterin announced at the Ethereum Community Conference (EthCC) that there would be a few more stages in Ethereum’s development roadmap after The Merge:

- The Surge: This will introduce side-chains and sharding to Ethereum and is scheduled for 2023; it will also reduce transaction times and costs.

- The Verge: Introduction of Verkle Trees, upgrades to existing Merkle proofs. Verkle Trees will optimize network storage and decrease the size of existing nodes.

- The Purge: This stage will prioritize reducing network congestion and streamlining network storage by eliminating unnecessary historical data.

- The Splurge: A series of smaller upgrades to fine-tune network operations and address any issues arising from the previous development stages.

As per Vitalik, development work is only about 55% complete post-Merge—this means there’s still plenty of development work to be done.

For those concerned about gas prices, this should come as welcome news. The Merge proved that the Ethereum development community can tackle massive technical achievements. Lowering gas fees is clearly on their radar and will receive more attention following the shift to PoS.

How to Transact When Gas Fees Are Lowest

While The Merge didn't directly tackle gas fee improvements, Blocknative’s Gas Estimator lets you stay informed regarding the ETH you are spending on transactions.

We offer web3's most accurate ETH gas fee tracker, allowing you to monitor gas prices in real time. This data is integrated within the following features:

- A gas tracking browser plugin that notifies you when prices reach your desired level

- A historic gas heatmap

- Next block gas fee prediction feature

To learn more about Blocknative and how we can help your project save on gas fees, contact us for a demo today.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension