The Merge is complete and it was the most significant and substantial upgrade Ethereum has experienced to date. The network made the transition to proof-of-stake (PoS), rewarding years of research and persistence by the community.

While there are many intricacies surrounding how The Merge changed Ethereum today and how it will continue to impact the future – today we’re focused on Block Building.

What is block building? Public blockchain networks batch transactions into blocks. The term “block building” is used to describe the process of precisely ordering the transactions that end up being included in these blocks. Each block contains transactions that occurred over a certain period of time in the network’s history.

Since these blocks cannot be edited after they are confirmed by the network, their ordering is critical. “Block building” is how the history of a network is written at the most granular level, transaction-by-transaction. A “block builder” is a network participant that can influence the way that these transactions are ordered.

In this post, we’ll cover the pre-Merge history of block building on Ethereum, how it changed after The Merge, what those changes mean for Ethereum’s users, and how Blocknative can help you embrace these new economic realities.

Block Building in Proof-of-Work

To better understand the importance of the shift that occurred with The Merge, it’s essential to review how block building worked under Ethereum’s proof-of-work (PoW) system.

Previously, Ethereum miners completed the job of both validating the network’s blocks and building the blocks. These miners had the final say in the exact order of all the transactions that they confirmed.

This was a powerful position to be in; controlling the flow of transactions allowed them to profit from on-chain activities. The value that was extracted by miners is referred to as Maximal Extractable Value (MEV). It originally stood for “Miner Extractable Value", but this name has fallen out of popularity as, today, far more actors on the network participate in the MEV process.

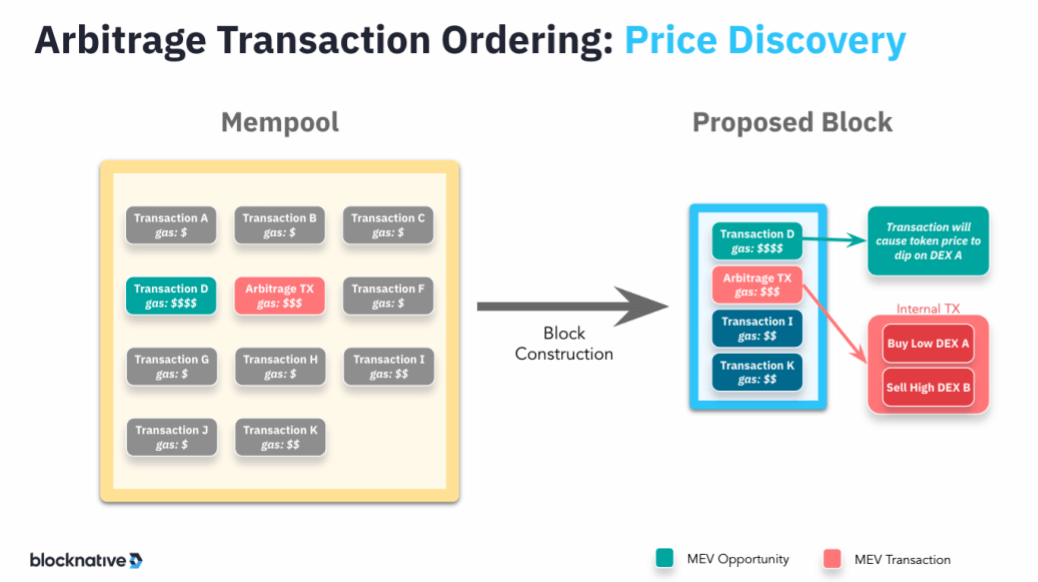

With increasingly sophisticated on-chain financial activity occurring on Ethereum, MEV “searchers” have emerged that specialize in capitalizing on the related arbitrage opportunities. These searchers monitor the mempool looking for opportunities to profit by strategically ordering the contents of a specific block.

An example of MEV arbitrage transaction ordering

Because the knowledge involved in being a good searcher is specialized, it was rare for a top-tier MEV searcher to also happen to be a mining pool operator. With this in mind, searchers in the previous PoW environment still needed to collaborate with miners to ensure that their MEV-rich transaction bundles were included in blocks.

This was done through communication channels that were largely developed by the research collective/company Flashbots. Their open marketplace for MEV allowed searchers to submit transaction bundles to miners for inclusion in blocks. To gain the attention of a miner, they also include payments for the miner that amounted to a share of the MEV they expected to earn from the transaction bundle.

This became a third source of revenue for miners under PoW. They received the issuance for winning a block, the priority fee of transactions, and payments for including MEV on behalf of searchers that requested specific transaction ordering.

To be clear, it was never required at the protocol level that miners do this. However, thanks to the economic incentives at play, the overwhelming majority of them collaborated with MEV searchers. Flashbots estimated in the past that “>90% of miners are outsourcing some of their block construction to Flashbots”.

In summary, the block building lifecycle looked like this under PoW:

- Human users and dapps generated economic activity on the Ethereum network that triggered arbitrage opportunities.

- Sophisticated actors called “searchers” competed to see who could create MEV-focused transaction bundles in a way that makes the most of these opportunities. They then offered these bundles to miners and incentivized inclusion by giving miners a cut of the MEV that would be generated.

- Ethereum miners monitored the transaction bundles being offered by searchers and picked the most lucrative options to include in their blocks.

A New Frontier: Proof-of-Stake

Now that we understand the previous state of block building on Ethereum, let’s explore the current post-Merge PoS environment.

The Merge ushered in the era of “validators” on the network. While PoW was dependent on users expending physical energy in the form of mining to prove trustworthiness, PoS requires users to follow a different set of rules that are dependent on staking ETH. Here’s how Ethereum.org outlines the process:

“To participate as a validator, a user must deposit 32 ETH into the deposit contract and run three separate pieces of software: an execution client, a consensus client, and a validator. On depositing their ether, the user joins an activation queue that limits the rate of new validators joining the network. Once activated, validators receive new blocks from peers on the Ethereum network. The transactions delivered in the block are re-executed, and the block signature is checked to ensure the block is valid. The validator then sends a vote (called an attestation) in favor of that block across the network.

Whereas under proof-of-work, the timing of blocks is determined by the mining difficulty, in proof-of-stake, the tempo is fixed. Time in proof-of-stake Ethereum is divided into slots (12 seconds) and epochs (32 slots). One validator is randomly selected to be a block proposer in every slot. This validator is responsible for creating a new block and sending it out to other nodes on the network.”

While the requirements for becoming a validator under PoS are not small, they are substantially less than what was previously needed to compete as a PoW miner. The completion of The Merge has led to an influx of first-time validators, which is key to further decentralization of Ethereum’s network.

Many of these newer validators lack the skill to build optimized, profitable blocks the same way that miners were able to. This is where block builders come into play. Instead of all block building happening via the network's previous validator equivalent (miners), under PoS anyone is now allowed to participate in the process of building blocks and proposing them to validators.

The Importance of Block Builders

Block Building was prioritized in the switch to PoS as a mechanism to help preserve the decentralization of the network. The underlying concept is called proposer/builder separation (PBS). Vitalik covers the logic behind this prioritization in this manner:

In the current transaction market, the block proposer (today: a miner, post-merge: a validator) directly chooses which transactions to include in the next block by looking at which transactions in the mempool pay the highest priority fee. This puts the block proposer in a position to use sophisticated strategies to choose which transactions to include, or even include their own, to take advantage of opportunities such as DEX arbitrage and liquidations (hereinafter just called “MEV” for simplicity) to maximize their profits. The complexity of these strategies creates a high fixed cost in running an effective miner or validator, and advantages centralized pools that take on this task on behalf of their participants.

Proposer/builder separation (PBS) fixes this by splitting the block construction role from the block proposal role. A separate class of actors called builders build exec block bodies (essentially an ordered list of transactions that becomes the main “payload” of the block), and submit bids.

A key piece of information to understand regarding validators and the post-merge Ethereum block building landscape is this: While proposer/builder separation is on track to be baked into the network’s consensus rules at the protocol level in the next 6 - 12 months, The Merge did not make it a requirement of the network.

So if proposer/builder separation didn’t happen during The Merge, how does block building happen?

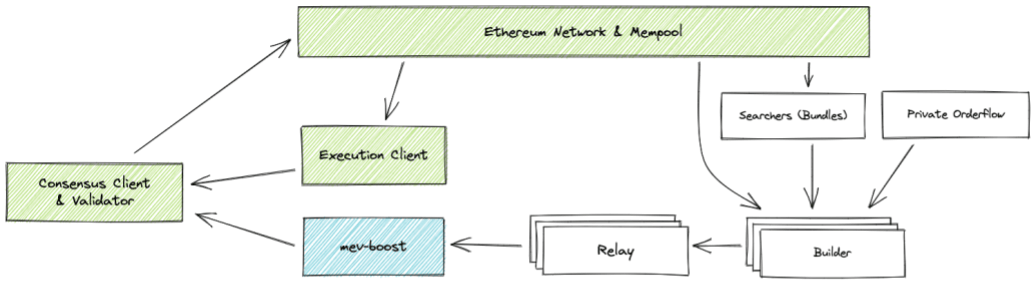

Currently, PoS block building is alive and well on Ethereum thanks to decentralized community efforts that have rallied around ways to streamline how MEV is discovered and utilized on the network. These coalesced into a project known as MEV-boost which is described as such:

“mev-boost can connect to relays that aggregate multiple builders. The builders prepare full blocks, optimizing for MEV extraction and fair distribution of the rewards. The Consensus Layer client of the validator proposes the most profitable block received from mev-boost.”

Image sourced from Flashbots GitHub

Ethereum had support for MEV-boost shortly after The Merge went live, meaning that there was a built-in option for actors to begin building blocks from scratch and proposing them to validators via relays for confirmation. Blocknative is proud to offer one of these MEV relays via our open source project, Dreamboat.

One thing that did not change in the migration from PoW to PoS was validator incentivization. In the same manner that competing MEV searchers used to incentivize miner inclusion by offering a percentage cut of their profits, block builders incentivize validators to utilize their blocks by offering a percentage of the MEV they’ve captured. The difference today compared to PoW Ethereum is that this value now flows in a more decentralized fashion that creates new economic possibilities for actors on the network.

It’s important to understand the way that this change reflects an overall goal of The Merge to move Ethereum’s network towards a more modular future. Specifically, the transition to PoS was an aggressive move towards decentralization through modularity.

When you break apart the different pieces of block construction, you can decentralize them individually. This allows different actors with different specialties to focus on their particular strengths. The net result is a more capable network with fewer external dependencies and a lower threshold for participation.

The New Economic Realities of Block Building

We now understand that the migration to PoS introduced a fundamentally new economic actor (block builders) that plays an important role in supporting the underlying mission of increasing modularity.

While this is interesting on its own, the fascinating part of the transition is that, beyond knowing there will be a new class of economic actors, we do not know how these actors will act in the long term. We’re experiencing a radical shift: New actors, new behaviors, and the possibility of exciting new outcomes.

Who are these new actors? Block building is resource-intensive and requires significant network bandwidth. Today, Blocknative along with Flashbots, Manifold, BloxRoute, and Eden represent the primary block builders on the network. Statistics regarding block building actors and activity can be tracked via https://www.mevboost.org/.

While the current group of block builders is small, there’s no guarantee that will continue. New block builders will likely emerge via groups that already have similar capabilities on the Ethereum network. Existing infrastructure providers like Infura are certainly likely candidates. And while we do not know exactly who will continue to join in these duties, it’s best for the ecosystem if this process is highly decentralized.

Part of the reason that the decentralization of block builders is important is that it will encourage diversity in the types of blocks that are prioritized. Everyone competes to build the “best” blocks. But what makes a block the “best”?

Currently, the variety of blocks produced via MEV-boost is mainly concentrated around maximizing MEV or adhering to certain compliance guidelines. But what are the other options that may develop? Here at Blocknative we believe there will be incentives for a wide variety of PBS blocks including (but not limited to):

- Maximum MEV

- Fair Ordered

- Benevolent-Only MEV

- Gas Price Ordered

- Time Ordered

- Futures Auctioned

- Censorship Enabled

It will be up to the choices of validators to determine what types of blocks will gain traction. You may think that the obvious answer is that validators will choose the blocks that maximize their profit (Maximum MEV), but the reality is likely to be more complicated.

Remember, there is a wider collection of individuals acting as validators under PoS than there were miners on PoW Ethereum. The miners that used to prioritize profitable MEV were largely nameless, faceless entities. This is no longer the case with PoS Ethereum. While some validators are anonymous, there are other validators run by well-known members of the community.

There are questions to be asked regarding the social pressures that will evolve around block selection. Will someone with an outstanding reputation in the web3 community select a block with blatant front-running and MEV-based censorship when it is their validator’s turn to propose a block?

Legal considerations are also in play. Regulators are starting to pay attention to MEV since activities such as front-running are outlawed in legacy financial markets. Since exchanges such as Coinbase and Binance are operating validators on behalf of staking customers, their legal teams are having to weigh the risks of toxic MEV being proposed by a heavily regulated cryptocurrency exchange.

Currently, less than 25% of Ethereum validators are utilizing MEV-boost. This may be because large validators are still weighing their options on how to best approach block selection. As a wider variety of blocks is made available, more validators may feel comfortable enabling the expanded rewards made possible by MEV-boost.

Decentralized block building under PoS also opens up the potential for a previously overlooked economic actor in the Ethereum ecosystem to gain access to the fruits of MEV: Users.

This is hugely exciting as Blocknative CEO Matt Cutler outlined in his recent Bankless interview:

“There's a user, there's a wallet, there’s a dapp, there's a protocol, all of which you could sort of look at and say ‘these are the sources of transactions of which MEV results’...Wouldn't it be a more level playing field if they were to participate in this as well?...So now you can have block builders that provide rebates. I always like to say imagine instead of you having a wallet that you add money to pay for your gas fees, your wallet pays your user…One might imagine different wallets with different techniques (for) how much they capture versus how much to share. And then users now have all sorts of new possibilities to select which wallet provides the greatest rate of rebate.

(S)o if you're a dapp developer, you can participate in this. If you are a wallet developer, you can participate in this. If you're a protocol, you can potentially participate in this as well. And so now as a block builder, you have the opportunity to take that (into consideration for) blocks. And instead of just giving (MEV) all to the validator, you can say ‘I want to share some of it with the user’.”

Reward credit card style rebates for utilizing crypto apps? It’s a real possibility. Since individual network participants are the originators of all MEV opportunities on the network, there is a logical argument that can be made around returning some of this value to them. If the idea becomes widespread, validators could face significant community pressure to select more equitable blocks.

Blocknative Is Here to Help

All of the outcomes presented above are dependent on decentralized community action. It will be up to the validators, MEV searchers, developers, users, and infrastructure providers to coordinate and align on healthy block building practices.

With this in mind, we want to make one thing clear: Blocknative is committed to promoting and enabling progressive block building.

If you want to join this mission, contact us today. With our robust toolkit of web3 developer tools focused on the pre-chain layer, no team is better situated to allow you to thrive within PoS block building.

Monitor transactions with Mempool Explorer, keep tabs on ETH gas fees in real-time, or simulate transactions to see the on-chain future before it happens. And if you’re looking to make sure that as many users as possible can interact with your project, utilize Web3 Onboard, the most powerful connect wallet button in the industry.

Want to learn even more about post-Merge block building? Check out the full recording of Blocknative CEO Matt Cutler on Bankless.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension