The following video is a recording of Blocknative CEO Matt Cutler's discussion at ETHDenver 2023 regarding the current state of block building and MEV on Ethereum.

A full transcript is available below and the slides can be found here.

Recap Video

Transcript

Slide 1

Good morning everyone thanks for joining us! My name is Matt Cutler. I'm co-founder and CEO at Blocknative.

We're going to spend about the next 20 minutes or so talking about block building and MEV. State of the market, what's going on and why.

I like to start this off by asking everybody: “Hey, did you eat anything today?” Most of us have probably had some breakfast and while you're eating, did you think a little bit about where your food comes from? And often we do and the reason why is we kind of know that we are what we eat.

Now, the parallel here is have you done a transaction onchain this year? And if so have you thought about how it got there? Because it turns out how your transactions go from your wallet to being onchain, have changed a whole bunch at The Merge, and entities like us, Blocknative, are responsible for ensuring that your transactions get onchain in an orderly fashion.

And so what we're going to do is talk about how all this stuff works. It's kind of surprising and there's a whole bunch of new interesting possibilities surrounding it that are really pretty fun and interesting.

Slide 2

So we're going to talk about block building pre and post-Merge, we’re going to talk about the fundamentals of this mysterious force called MEV, we’re going to talk about PBS (proposer/builder separation) in the wild, and a new initiative that we've been working on called #ShareTheMEV.

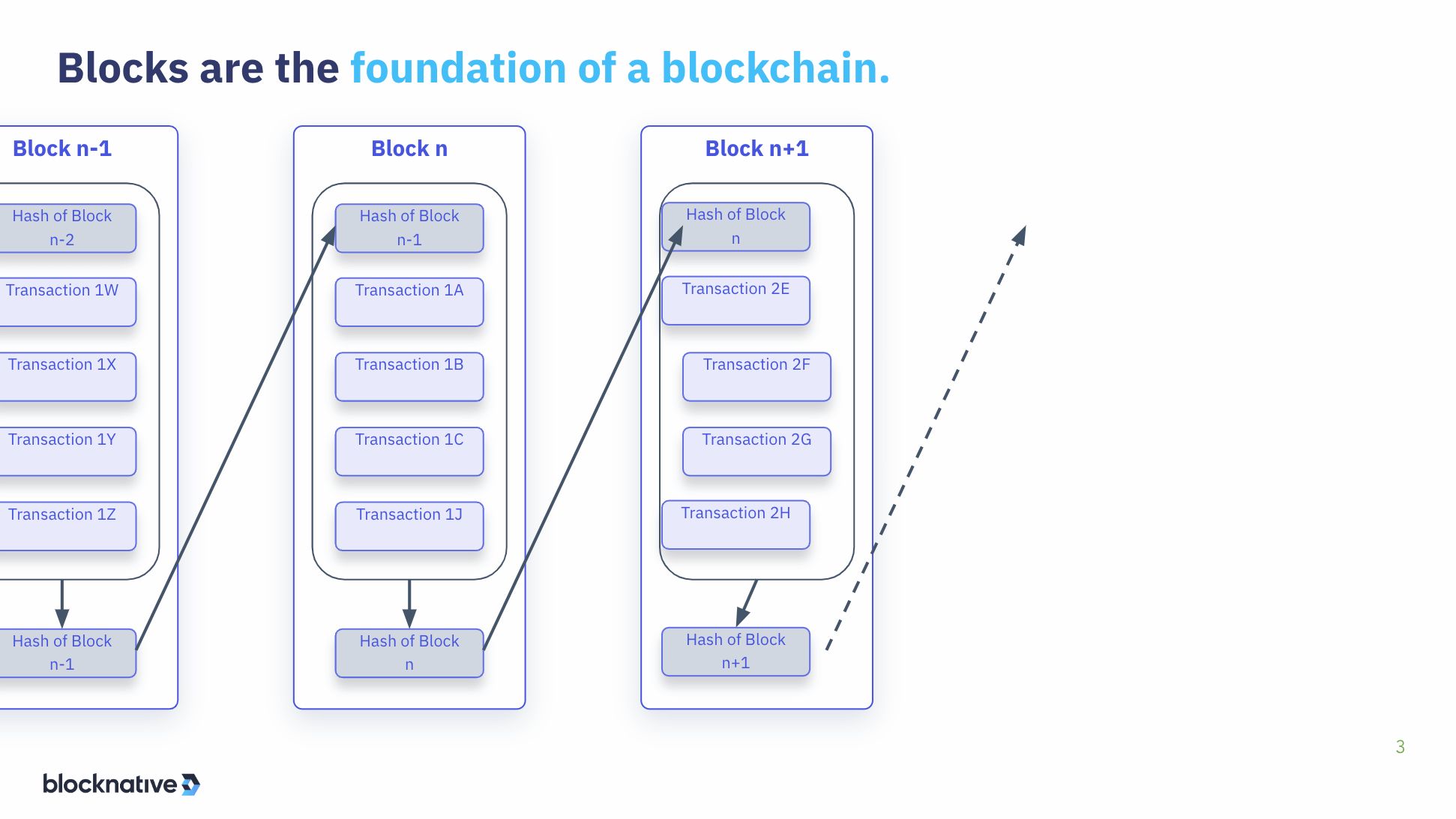

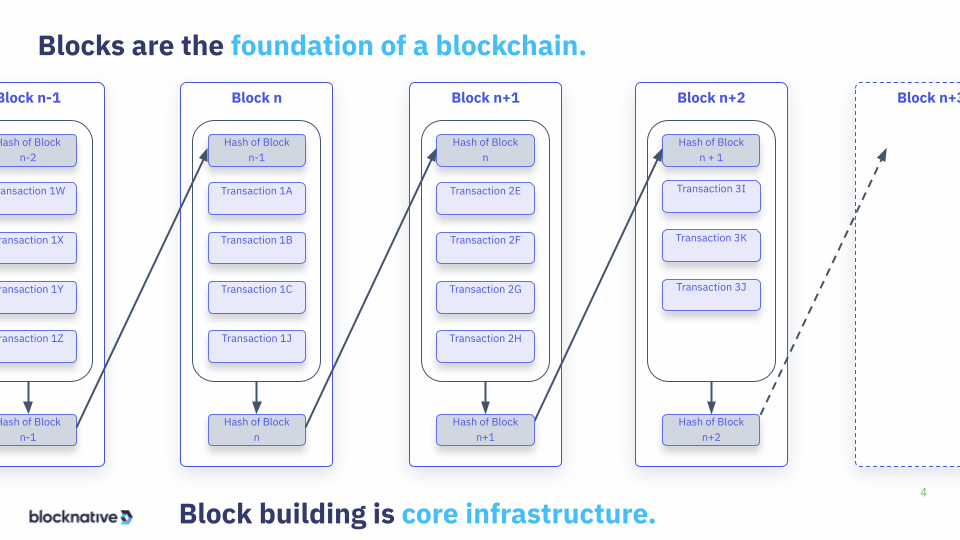

Slide 3

So at the end of the day, we're all here for blockchain stuff. Transactions go into block, they get ordered, they get hashed, they get put into the next block, and whoever's in position to build this block, is core infrastructure.

Slide 4

And I always ask people “have you ever thought about how that happens like who is responsible for actually constructing the block?”

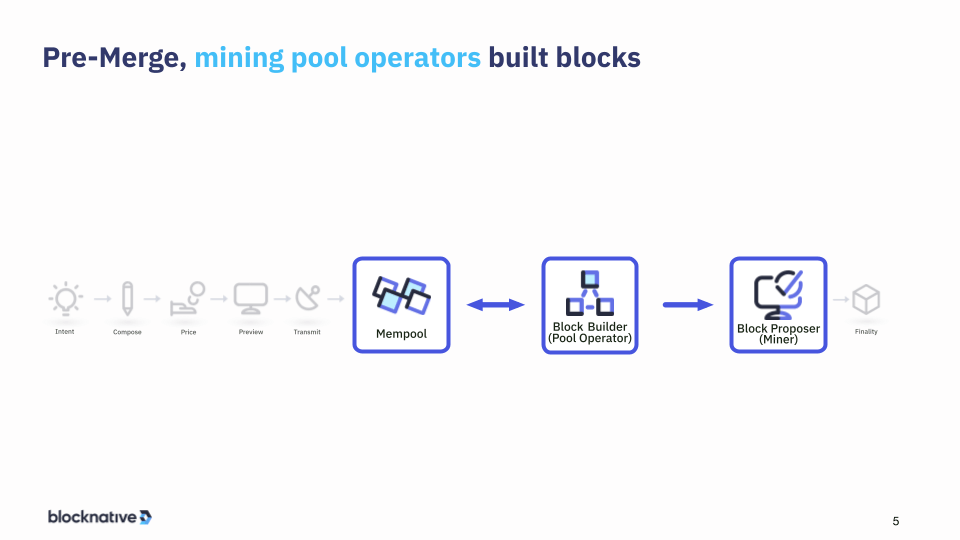

Slide 5

And the answer is pretty surprising because under proof of work (pre-Merge) the people who built blocks, there were literally like four or five entities on the entire planet that built virtually, all the blocks, they were the mining pool operators.

So the Ethereum network under proof-of-work was secured by computers solving math problems but they were largely organized into mining pools. And when your organized into a mining pool, the block template, i.e. which transactions are in what order get handed to you by the mining pool operators.

So this was vastly more centralized than most people anticipated. Virtually all the mining pools were located offshore and subject to different jurisdictions and there was evidence of manipulation occurring at the block builder level because it turns out sophisticated actors with lots of resources, if you can create offchain agreements, you can get preferential treatment.

And that's not so much in line with the values of web3 as an equitable system for us to work with.

Slide 6

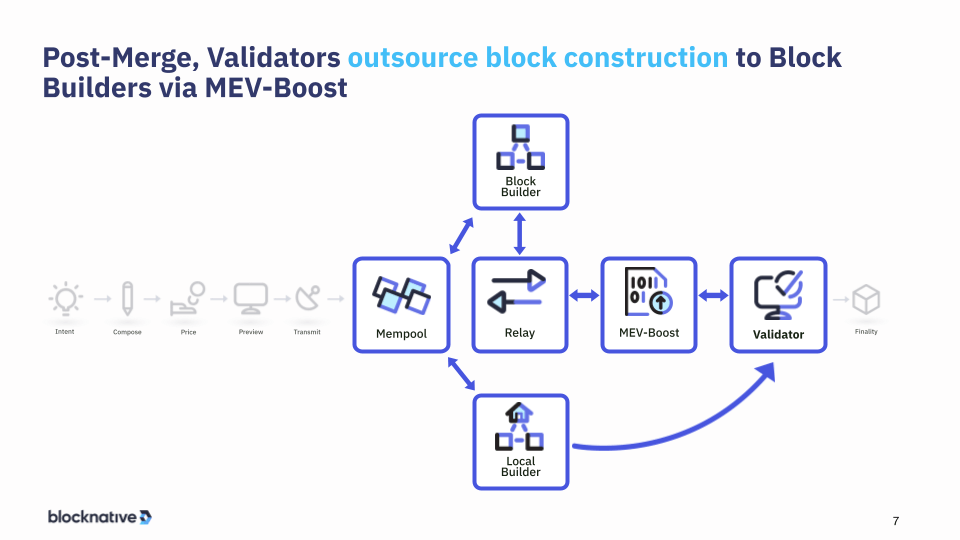

And so there's a whole bunch of work that happened around this to basically try to better understand what was happening and try to open this up and the good news is at The Merge.

One of the fundamental changes to the network is known as proposal builder separation. And what happens in proposal builders separation is a validator, someone who is locking up ETH and has the opportunity to help secure the network, they assume the role of proposer, meaning they have the opportunity to propose a block to the network.

Slide 7

Now they could build their own block, or using the sidecar known as MEV-Boost, they could outsource block production to a third party set of actors known as block builders like us. Specialist providers, whose job it is, is to build great blocks for the network. Okay? And the interesting question is, why is this a thing? Why is this happening? And what's going on here?

Slide 8

And this is optional. So the validator has the option to run this thing called MEV-Boost and you'll notice MEV-Boost has these magical three letters. MEV is maximal extractable value and that is value derived from explicit manipulation of transaction ordering. All transaction systems have to be ordered and it turns out if you can control that ordering, you can set all sorts of value and that's how this whole system works.

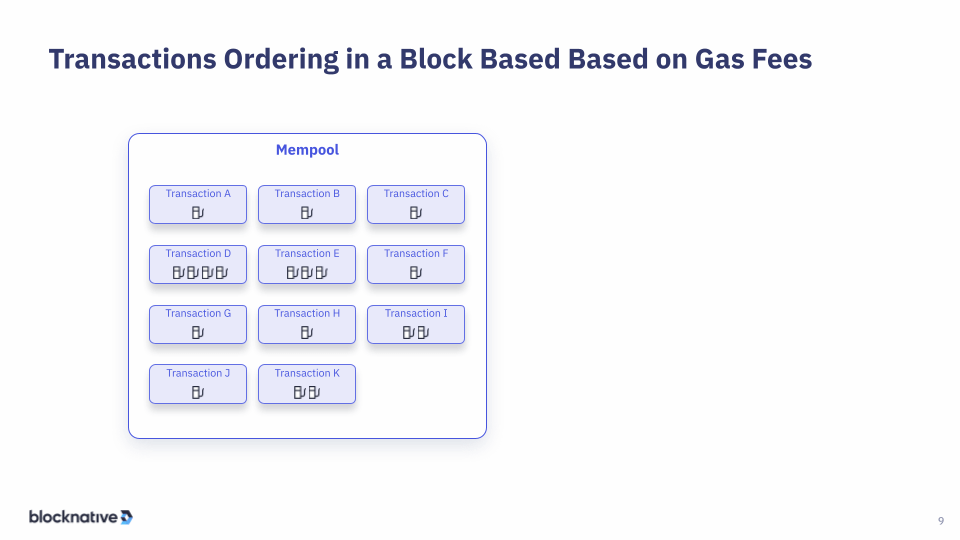

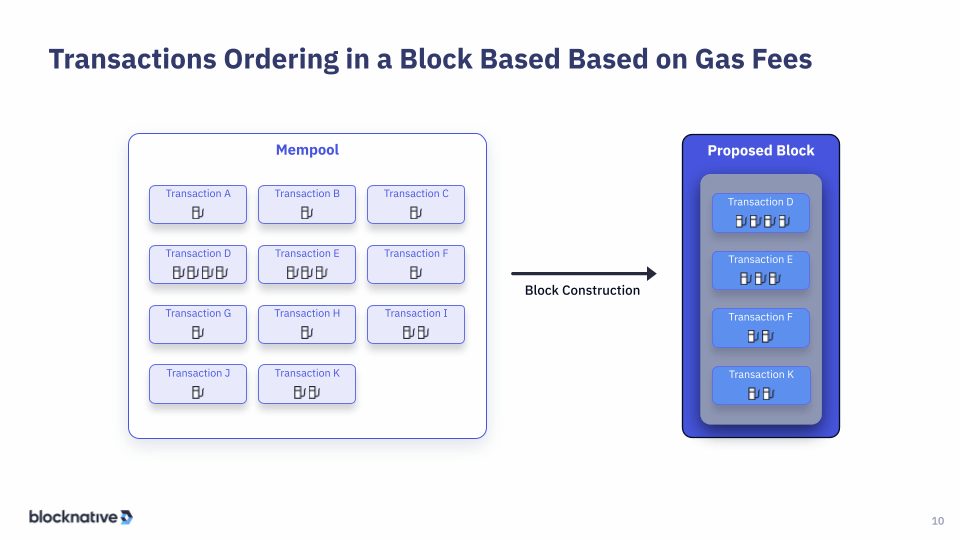

Slide 9

So, naive transaction ordering is, you take the transactions of the mempool. You can see each one of these transactions has various gas prices.

Slide 10

And you just set up the block to say the most valuable transaction in terms of gas price goes at the top and the least goes at the bottom. Awesome.

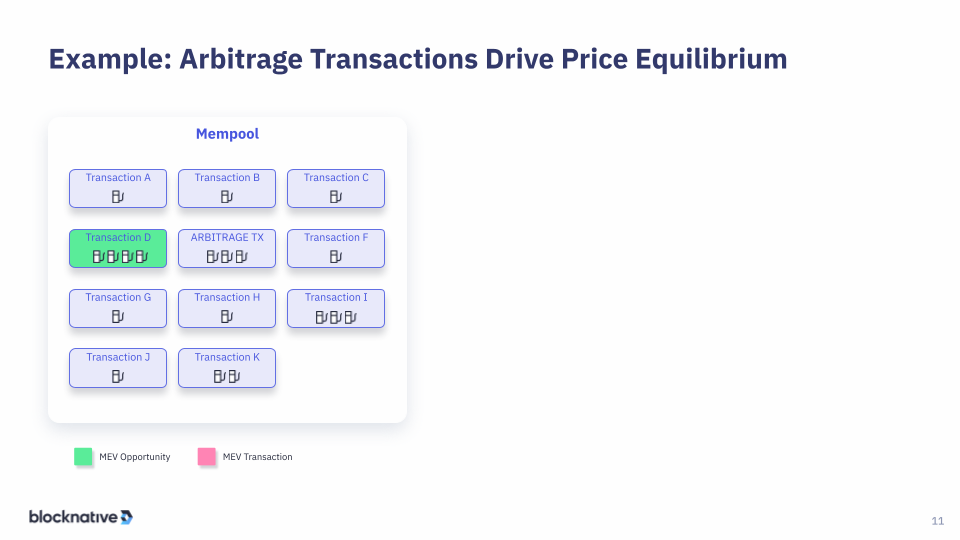

Slide 11

But, imagine there's a transaction here, transaction D, which moves the price on an exchange. And now there's a price differential between exchanges, which sets up an arbitrage opportunity, meaning someone can insert a transaction and basically normalize prices and extract a little bit of a profit which is great for the health of the network.

But see this arbitrage transaction has the same gas as transaction I. And so who's ever doing this arbitrage transaction isn't exactly sure they're going to get it right behind that.

And so what happens here is things like gas wars where people spam the network with all sorts of transactions in an effort to get right there and the whole network suffers because gas prices go up.

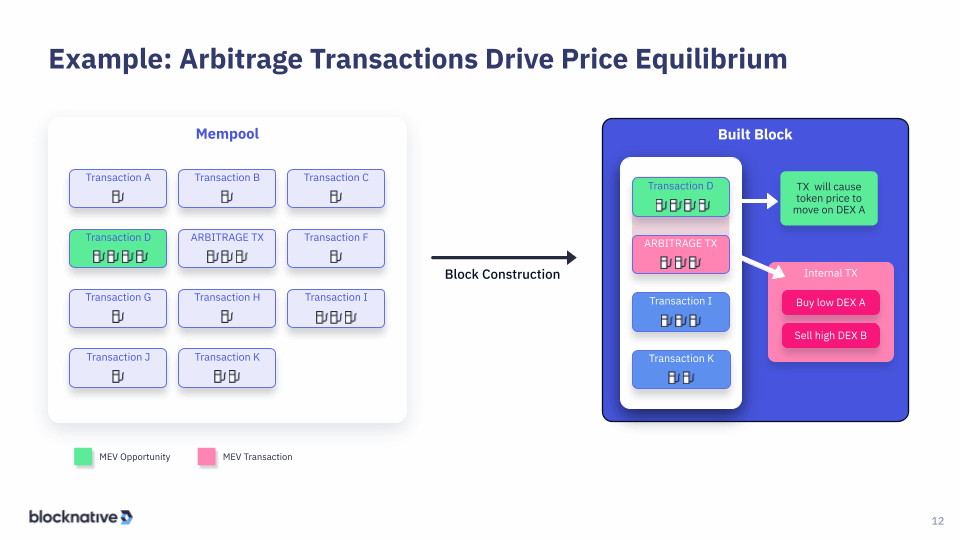

Slide 12

So instead what you do is you have what's called a bundle, where you bundle these two transactions together. And you say, if you include my arbitrage transaction right behind transaction D, maybe, there's $100 of profit, I'll pay you $50 to do this. So there's sharing of revenue in this ecosystem because there's value which can be extracted as a result of this ordering.

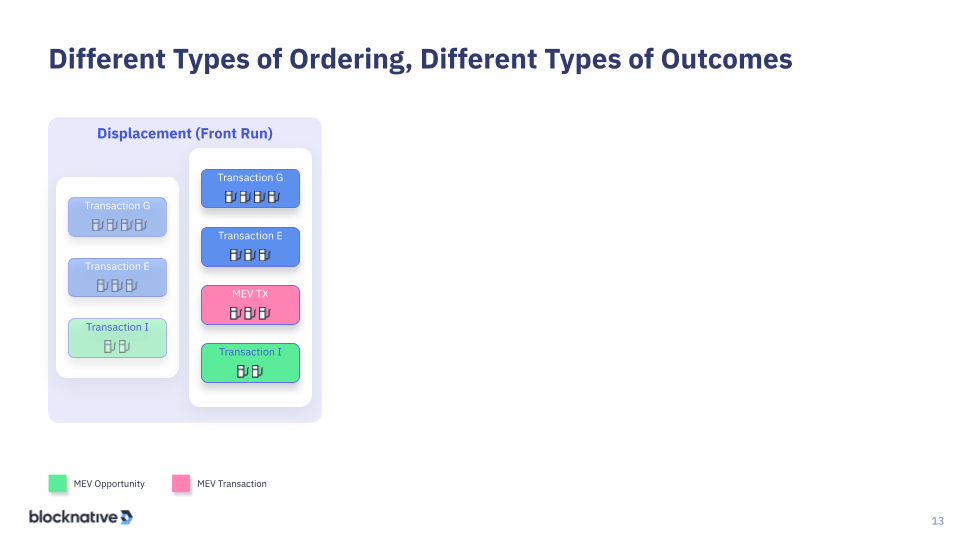

Slide 13

And there's all sorts of ways that this ordering can occur. There's front running where you're trying to get a transaction in front of another transaction

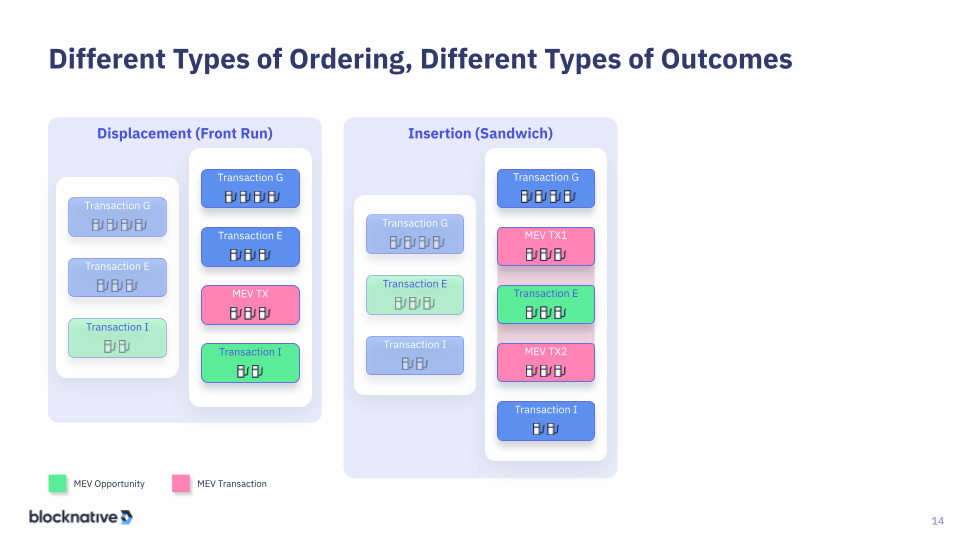

Slide 14

There’s sandwiching where you put a transaction in front and behind of a certain transaction. If anyone's ever done a Uniswap transaction on the public mempool this is what’s happened to you. And as a result of sandwiching, you suffer less favorable settlement. Not great.

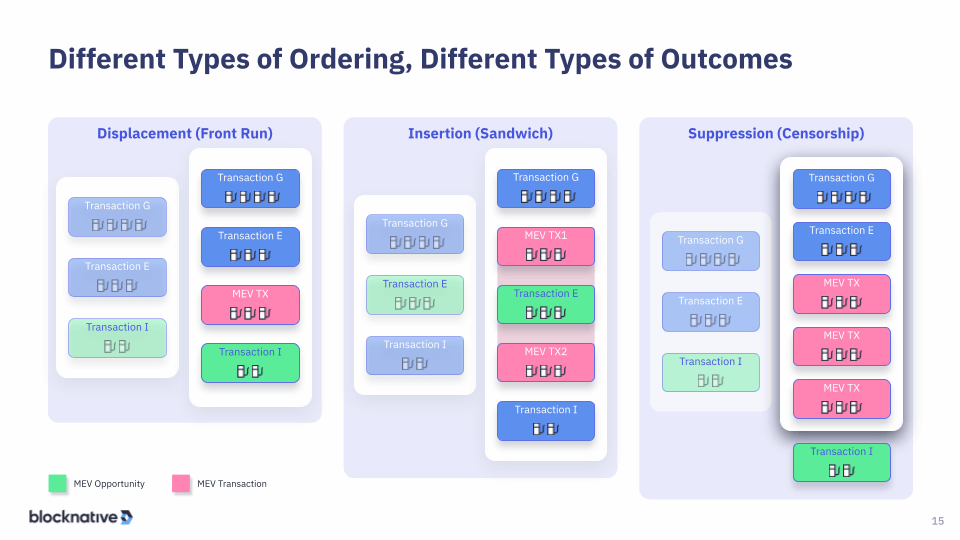

Slide 15

And there's even transaction suppression or censorship where you say, I don't want transaction I to get into this block. So I'm going to flood a bunch of other transactions in and push it off the bottom of the block. This is the sort of thing that happens with NFT drops. People try to get in front, your transaction doesn't get in.

Slide 16

So while MEV feels a little funny, it's actually everywhere. All ordered systems have MEV in them by definition.

So we're all used to search engines. We all know the idea that being search result one is more valuable than being search result, 12, right?

Why? Cuz there's more clicks. And we’re all pretty comfortable with the idea that there's this art called search engine optimization where you manipulate search engine indexing so you get higher ranking, right? No problem.

And we’re all used to the idea that when you call in to try to get concert tickets, the faster you get in, the better tickets you have access to. We all know that when weather gets bad at an airport, the airlines that have more gates get their planes landed on the smaller airlines get delayed.

These are all examples of MEV. However, in web3, it's open and transparent. We can see it but you can't see in any of these other systems. And that's what makes this really interesting and really powerful.

Slide 17

So does it work? So we made this big change at The Merge, it was about 5 and 1/2 months ago, and the simple answer is hell yes.

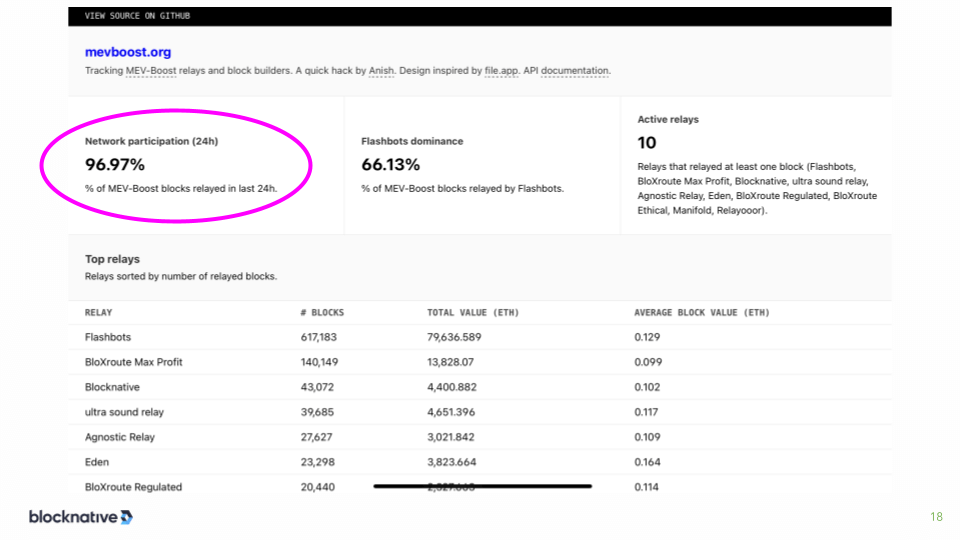

Slide 18

I took the screenshot earlier this week: 97% of all Ethereum mainnet blocks are outsourced to block producers like us. 97%.

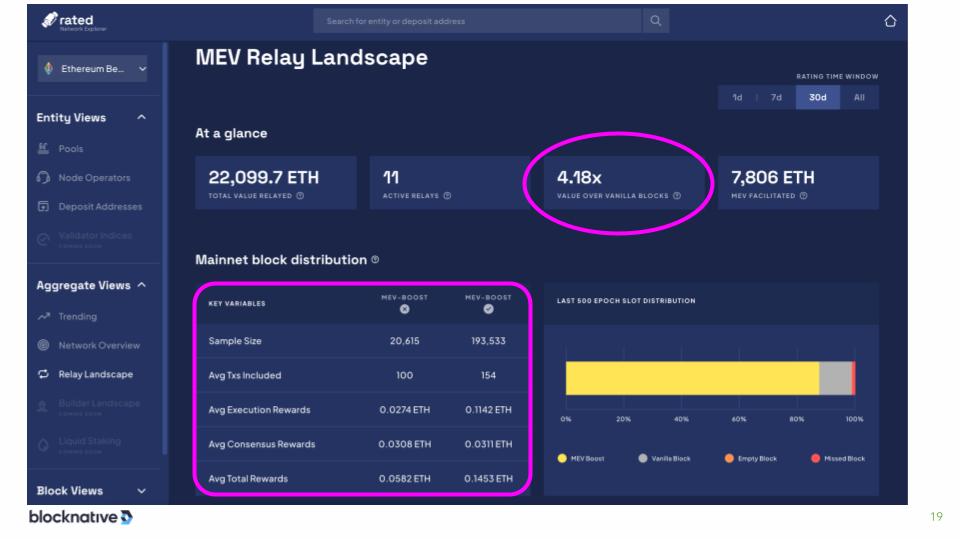

Slide 19

And why does this happen? Well because the rewards for a validator are 4.18x. So over 400% more value per block when outsourced. And interestingly, if you look down here, average transactions included: 100 for a vanilla block, 154 for an outsource block.

So professional block producers (or third party block producers) are much more efficient about including value in blocks, much more efficient about sharing that value with validators, and much more efficient about using black space effectively. So there's all sorts of incentives for the network to outsource block production to specialist providers, like us.

Now, by the way, I'm going through this, there's all these public dashboards on this. Which is what's awesome about PBS, everyone can see what’s happening. The last one was called MEVBoost.org. This one is known as Rated Network. There's another great one called RelayScan, and there’s tons of other ones out there as well.

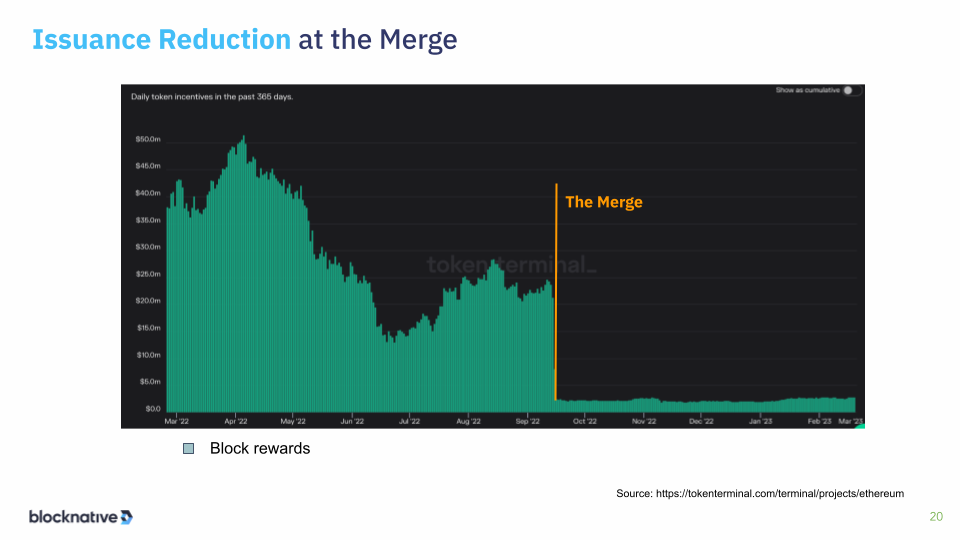

Slide 20

Now, one of the interesting things about The Merge is that prior to The Merge, when you wrote a block, you got a fairly significant rate of new ETH issuance because the network had to pay for the special computers and all the power needed to run it.

But we all know under Proof of Stake, you don't need any specialized compute at all. So the rate of issuance went way down. This is where the ultrasound money meme comes from is this massive reduction, the “triple halvening” rate of issuance.

Slide 21

But because the value in a block is a result of these three things, when issuance goes down, the relative influence of these other two things goes up.

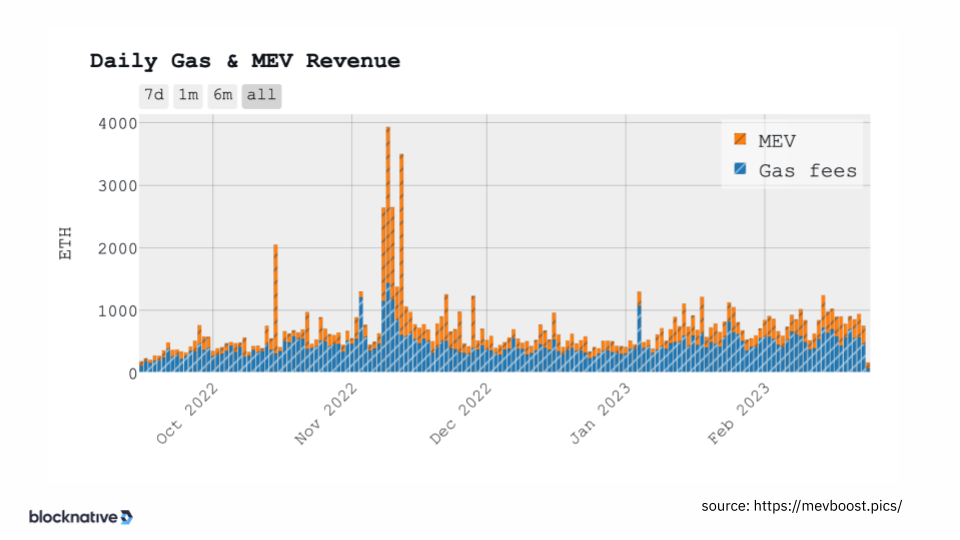

Slide 22

So here is a graph. The blue is the value in a block for gas fees. The orange is value from MEV, from transaction ordering.

Is the orange big or little on this? It's pretty big.

Slide 23

So while MEV itself hasn't really changed much as a result of The Merge, it now exerts a much greater influence on the network. Particularly in relative proportion, to the rate of issuance. So MEV is a bigger force than it was before. Not because MEV has changed, but as a result of this drop in issuance.

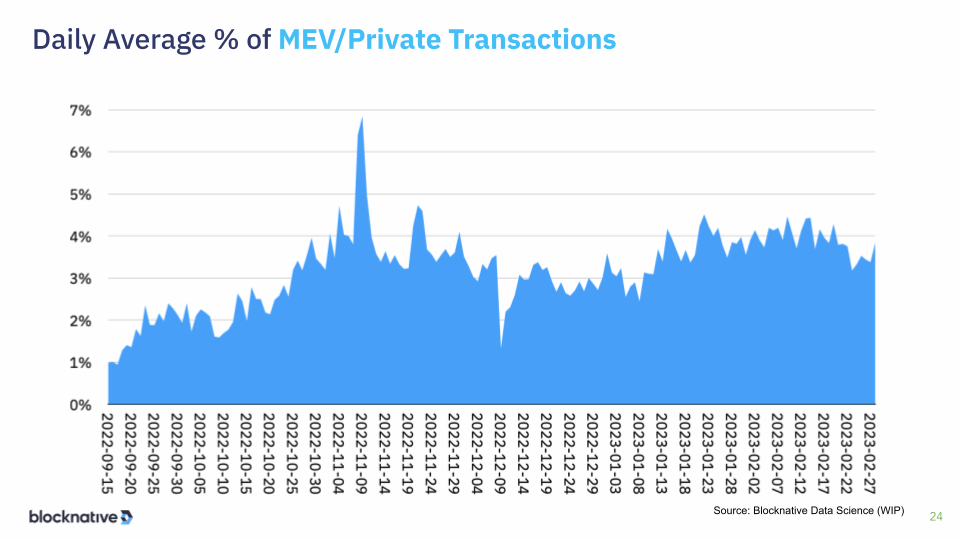

Slide 24

And what we're seeing here is the number of private transactions, MEV bundles, appears to be gradually rising. So, here's The Merge 9/15/23, about 1% of all transactions per block on average in a day were MEV bundles. And now you can see today it's between three and four percent of, on average on a given day, between three and four percent of all mainnet transactions are MEV bundles or otherwise private.

Slide 25

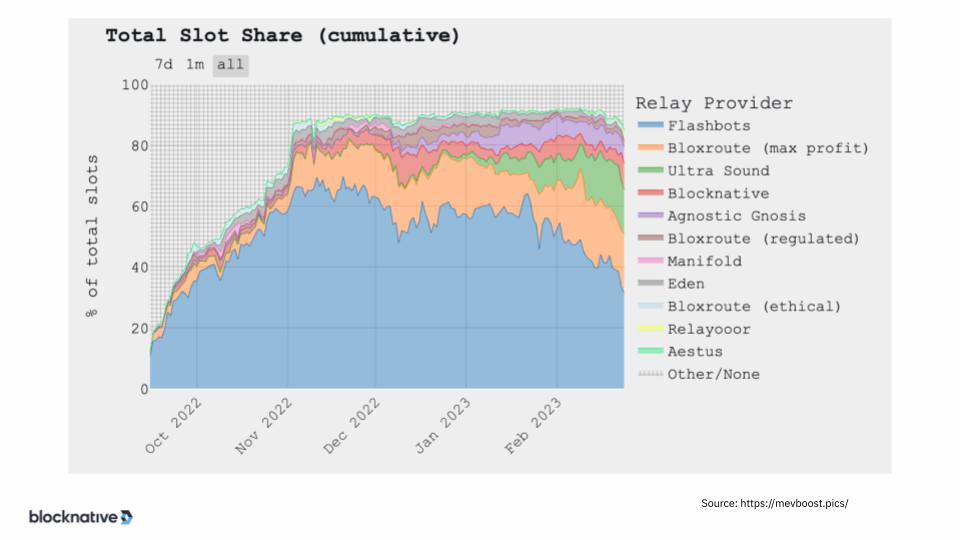

And you can see, we started at about 20% share of the network and now all these relays consist of more than 90% of the network. And by the way, the red here is Blocknative, that's us. We operate a relay as part of all of this.

Slide 26

So, PBS is going pretty well.

Slide 27

But there's plenty of room for improvement. It's new and while it solved a lot of interesting issues, it also raised some issues.

Slide 28

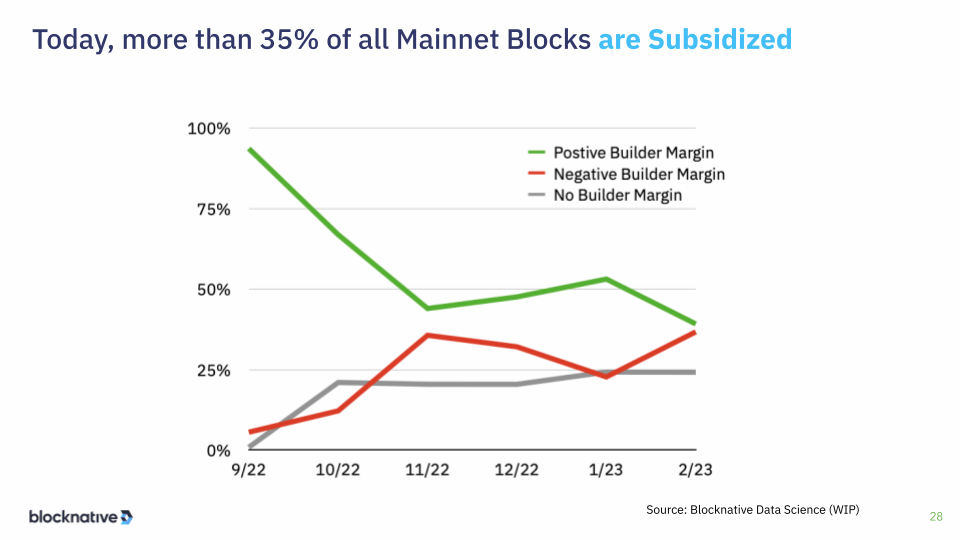

Like, when you produce a block and you propose it to the network you're basically competing with other block builders. So every 12 seconds, there's a new slot. We, as a builder, try to build the most profitable block, and we bid for the right to propose it.

Now, let's say we build a block for 1 ETH. We could bid 1 ETH. Like, exactly what we have. We take no margin as a result. We pass all the value onto the validator, and that's this gray line right here. This is “percent of blocks with no margin”.

Or we can say well there's 1 ETH of value, we're going to bid .9 ETH and if we win we capture 0.1 ETH that we can basically collect as revenue.

That's the green line. This is “number of blocks with positive margin”. But, what's happening today on the network, I don't think anyone really anticipated when they introduced PBS, is you can have a block of 1 ETH but you bid 1.1 ETH. You actually subsidize the network.

And what's interesting is the number of blocks with subsidies on average is going up. At the moment, about 35% of all blocks are subsidized. Like, who’s subsidizing? And what are they doing?

The vast majority of this subsidization is things like CEX>DEX arbitrage. Where you’re arbing between decentralized exchanges and centralized exchanges. But the arb that you're making on the centralized exchange doesn't appear onchain so from the perspective of block building it looks like negative subsidies or subsidies.

And so again it’s interesting, you can look into this and see which builders are subsidizing and wonder “why”. And also question “is this sustainable for the network”.

Now as a participant in this ecosystem, we think this green line should be healthier because ultimately, it's in everybody's best interest that this ecosystem is functioning properly. And I think the economics are getting there, it's just early and emerging.

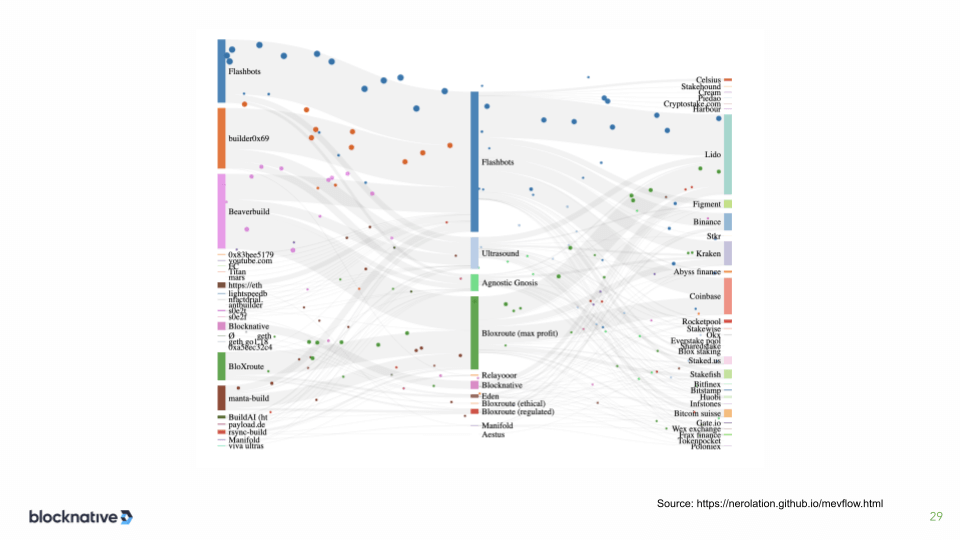

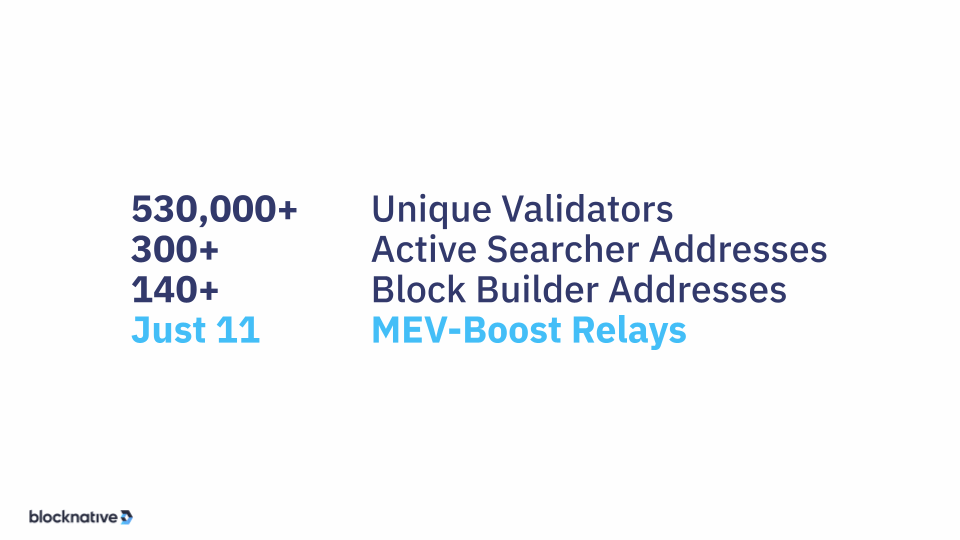

Slide 29

Now, this is a graph of all the builders, there’s about 140 builder addresses. There's 540,000 give or take validators, often in mining pools, and there's just 11 relays that stand in between. 97% of Ethereum blocks occur through MEV-Boost, and all of them go through one of these 11 relays, we're one of the relay operators, right?

But it would seem to us that we want more relay participation and greater levels of relay diversity. And each major staking pool can connect to various relays. Here’s Coinbase, they’re one of the largest, they talk to only two relays. So any block validated by Coinbase comes from one of two sources.

And again our attitude about all of this is, if you're operating a staking pool, you should probably be connecting to as many relays as possible to encourage diversity at the core of the network.

Slide 30

So, here you have that. We view this as not great. We think that there should be more economics at the MEV-Boost level, at the MEV-Boost relay level, and to encourage more participation because today there's no economics there.

Slide 31

But what all of this does is unlock programmable fluid expressive value flows.

Slide 32

And what's interesting here is we can start to think a bit differently about MEV.

Slide 33

In particular, where does MEV come from? Without a transaction, there's no MEV, and who does this transaction?

Slide 34

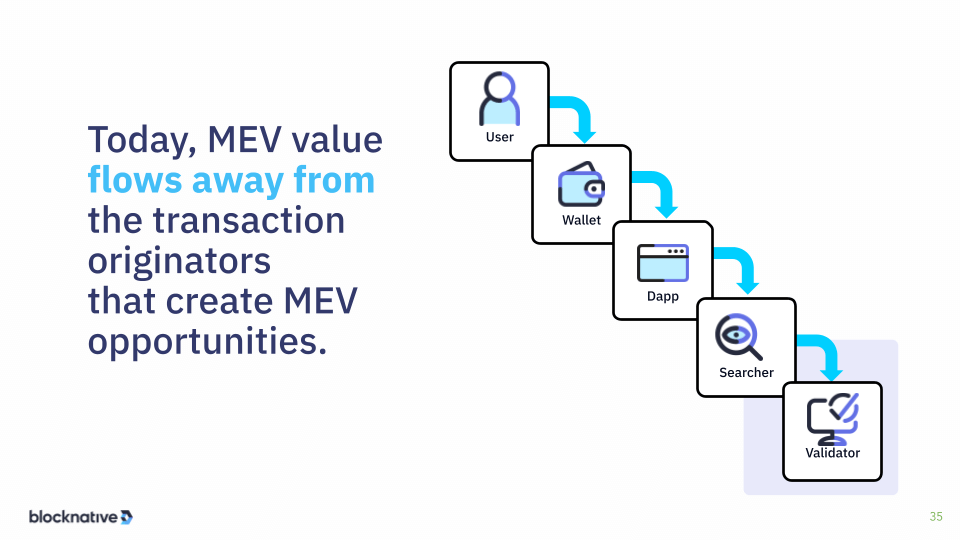

You do. Without an end user doing transactions, there's no MEV. Now when you do a transaction onchain are you aware that there might be MEV? No. Do you consent to being sandwiched or bundled? No. And the reason why is you have no opportunity to express your preference to the network, all the preference expression setting happens down the line.

Slide 35

And so, what happens is, while the value originates at the user and the wallet, and the dapp and protocol they use, it actually flows downhill, largely to the validator and the searcher.

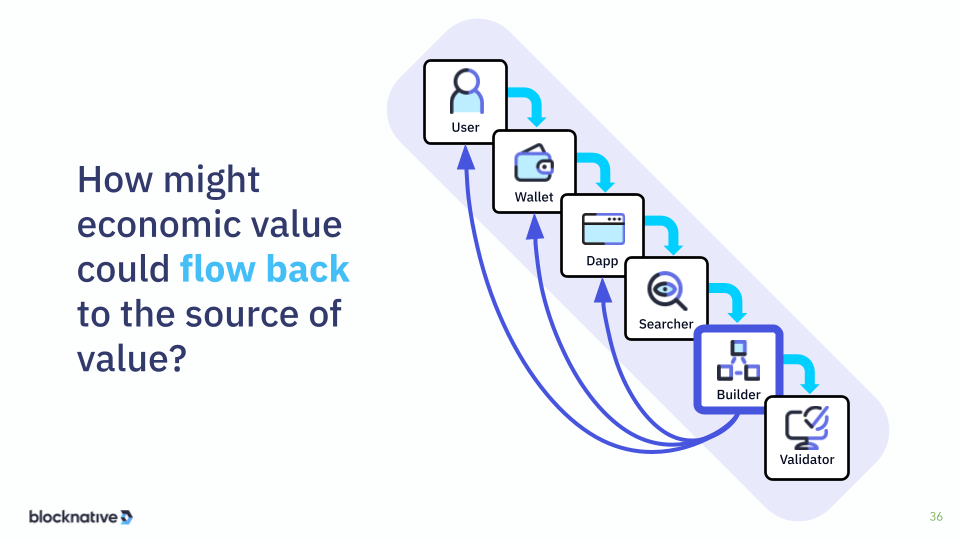

Slide 36

And we think that there might be better approaches here, where this value can be recirculated. Because you have third party builders like us, who can programmably specify how the block works, we can recirculate MEV value back up the value chain.

Slide 37

And so, we are actually working on a draft proposal right now that we're announcing here at ETHDenver that we're calling Wallet-Boost. It’s a sidecar for wallet providers to give them access and exposure to this magical world of MEV without having to have a ton of complexity in their infrastructure and without having to pollute the UI of the wallet experience.

So this is something that we're discussing with a variety of providers and if it's relevant for you, we encourage you to check it out. We encourage you to provide comments and feedback on it.

There are multiple proposals out there right now surrounding #ShareTheMEV which is a meme that we really started at the beginning of all of this. So we're quite excited about the level of industry activity around creating greater degrees of equity in the system so that value can, in fact, recirculate back.

And if you're interested to talk about this or anything that I’ve talked about today, we have a booth. It's right around the corner over here. Sort of by the spork whale lounge and we’d love to talk with you about that.

Slide 38

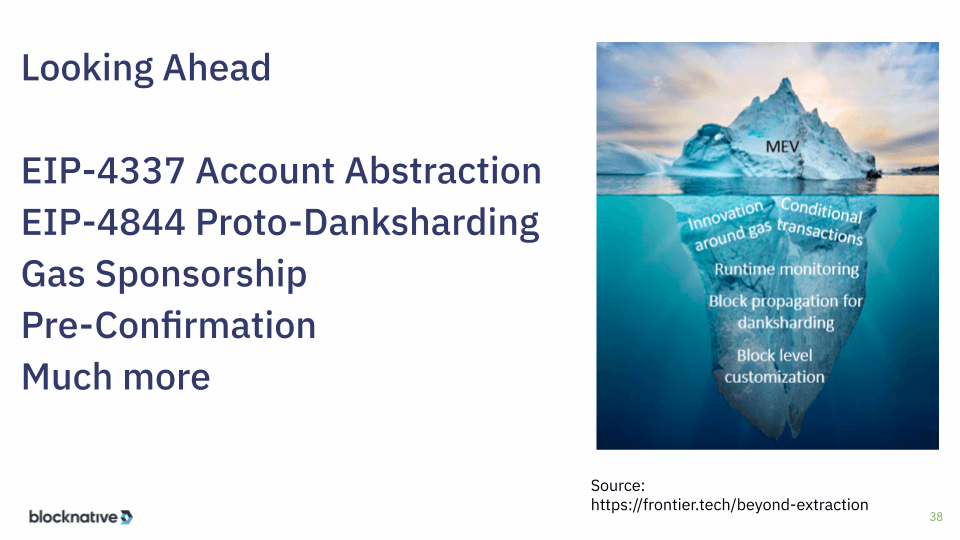

Now in closing, there's this whole new game on the network called block building. It involves outsourcing compute, network, and storage to a specialized set of actors who can construct valuable blocks on behalf of validators and basically keep the network operating and healthy.

But this model doesn't end with block building. In fact, when you have this, this source of compute, this source of networking, this source of power, you can use it in all sorts of other ways. So, coming soon is ERC-4337 account abstraction. And these same capabilities for block building can be applied there.

Similarly, right behind that. We have 4844 proto-danksharding with data availability sampling. The same set of infrastructure can facilitate here. And as you start to get more and more capabilities of the network with more and more, specialized actors, who can apply heavy compute to it, you can start to do all sorts of really interesting things like gas sponsorship, gas futures, block futures, pre-confirmation, and much more.

And so fundamentally these capabilities are basically going to be the underpinnings of all sorts of new capabilities at the core of the network that you as builders and developers can tap into, not because you’re geniuses about MEV, but because you have MEV aware infrastructure from block builder providers like Blocknative, who can help you build more powerful or usable more valuable applications.

And so, that's what we’re really excited about is providing this real time infrastructure that taps into all this stuff to make life easier for every level of the network. And so, that's what we do.

There's a great piece on this from Frontier Research, that’s where this comes from that’s basically saying that MEV’s the tip of the iceberg and that there's all sorts of more value coming and it's actually a really exciting time for this sort of stuff.

Slide 39

So with that I want to thank you. Oh, please #ShareTheMEV. Thank you for coming. My name is Matt Cutler. You can find me on Twitter @mcutler. We're Blocknative, we’re right around the corner. It's great to be here at ETHDenver, thanks for being here this morning and have a great rest of your show, okay.

Cheers everybody.

Build With Blocknative

Whether it's boosted MEV rewards for validators, programmable infrastructure for builders and searchers, or our Web3 Onboard for dapps and wallets, we provide real-time infrastructure that's helping shape the bright future of Ethereum.

We want to meet with you to hear what you're building with Blocknative and how we can help. You can contact us via our site today or reach out on Discord for direct support.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension