The Merge is complete, and it has revamped the economics of how Ethereum transactions are settled. Because MEV (maximal extractable value) is focused on the insertion of transactions (ordering, censorship, hijacking), this means there are profound changes regarding the way that MEV happens on-chain.

There are new actors involved in the process, the potential for new social pressures regarding certain types of MEV, and changes to the timeframes that these actors care about. Let’s explore the shifting post-Merge landscape.

How MEV Drives Validator Incentives

To understand MEV after The Merge, we must first look at who performs block confirmation on the network. While miners secured the network under Proof-of-Work, Proof-of-Stake Ethereum relies on “validators”.

To participate as an Ethereum validator, someone needs 32 ETH to stake and three separate pieces of software: an execution client, a consensus client, and a validator. Validators propose new blocks, submit attestations (votes), and monitor for any slashable offenses (penalties). To learn more about validators we recommend our full guide to The Merge, but for the sake of our current discussion, the key point to remember is this: Validators are the actors that ensure Ethereum’s network is secure and healthy.

This critical role requires good incentives. While some of these incentives are provided by the ETH that validators stake (and put at risk of slashing), rewards are offered as well. Validators receive roughly 1,700 ETH per day split between them (this number varies based on the total amount staked by all validators). Also, thanks to EIP-1559, they receive the Priority Fees that are “tipped” via transaction activity. You can use our Ethereum staking ROI calculator to see the average return that validators are currently receiving.

While payments in ETH and Priority Fee rewards are nice incentives for validators, it is a dramatically lower amount of rewards compared to what was previously captured by miners under PoW. Mining rewards pre-merge were equal to roughly 13,000 ETH per day. This means that validators now receive significantly less for their work compared to pre-merge miners (keep in mind, however, that validators should have a lower overhead cost than miners currently do).

This is where MEV comes into play. The majority of captured MEV used to accrue to miners under PoW. With the switch to PoS, this MEV is now structured to flow to validators. Importantly though, this is dependent on whether or not validators choose to act similarly to miners today. As we will cover in the following sections, the story could be more complicated.

A New Actor Emerges: Block Builders

Block Builders are a completely new Ethereum network actor that The Merge introduced to the table.

The process of determining which transactions are included in a block, and in which order, is known as “block building”. Under PoW, block building and mining (i.e. proposing and confirming a block) were handled by the same network actor. Because mining required specialized tools and knowledge, a small set of mining pool operators were responsible for the vast majority of block construction on PoW Ethereum. This changed with The Merge.

While block building and proposing are now still technical under the same person — the validator, the substantial influx of new validators post-Merge has resulted in participants that lack the skill to build optimized, profitable blocks the same way miners were able to.

As a result, The Merge created the conditions for a new class of core network economic actors to emerge: block builders. Block builders are specialist providers that compete in a real-time marketplace to perform block construction on behalf of validators. Eventually, this separation between block builders and proposers will be codified in the network under a concept known as proposer/builder separation (PBS). However, for now, PBS is completed via a protocol sidecar known as MEV-Boost. Blocknative supports MEV-Boost by operating our own block building MEV relay.

Our full guide to Ethereum block building outlines the landscape on a deeper level, but the importance of this change cannot be understated due to the impact it has had on the MEV landscape post-merge. Because of the new, decentralized nature of block building under PoS, there are avenues for different “types” of blocks to emerge. These could include (but are not limited to):

- Maximum MEV Blocks

- Benevolent-Only MEV Blocks

- Gas Price Ordered Blocks

- Time Ordered Blocks

- Futures Auctioned Blocks

- And more

While we are still in the early days of post-Merge MEV, some early differentiation has already appeared. There are blocks focusing on maximum profit MEV, “ethical” blocks that contain no MEV, and even blocks based on OFAC restrictions. You can keep track of the current landscape via https://www.mevboost.org/.

Generally, validator user behavior has been to select maximum MEV blocks from Flashbots. Currently, 89% utilize MEV-Boost blocks and the Flashbots dominance of these blocks is over 79%. In these early days, it's hard to conclude exactly how validators will behave in the future, but one key point to pay attention to is the move for more relay and block builder diversity. Blocknative highly recommends that validators connect to as many relays as possible to promote relay diversity throughout the network.

As a diversity of relay and block building options develop, validators may receive outside pressure to choose certain blocks. What happens once the general user base of Ethereum realizes that there are desirable block types that validators are choosing to ignore? And what if social incentives are put in place for validators that choose specific types of blocks?

Whereas blocks used to be confirmed by nameless, faceless, mining conglomerates, PoS validation increases the likelihood of entities with reputational risks acting as proposers. There’s more at stake than profit. Validators will have to consider the fact that each block they propose, and any harm caused by MEV within that block, may be permanently attached to their reputation.

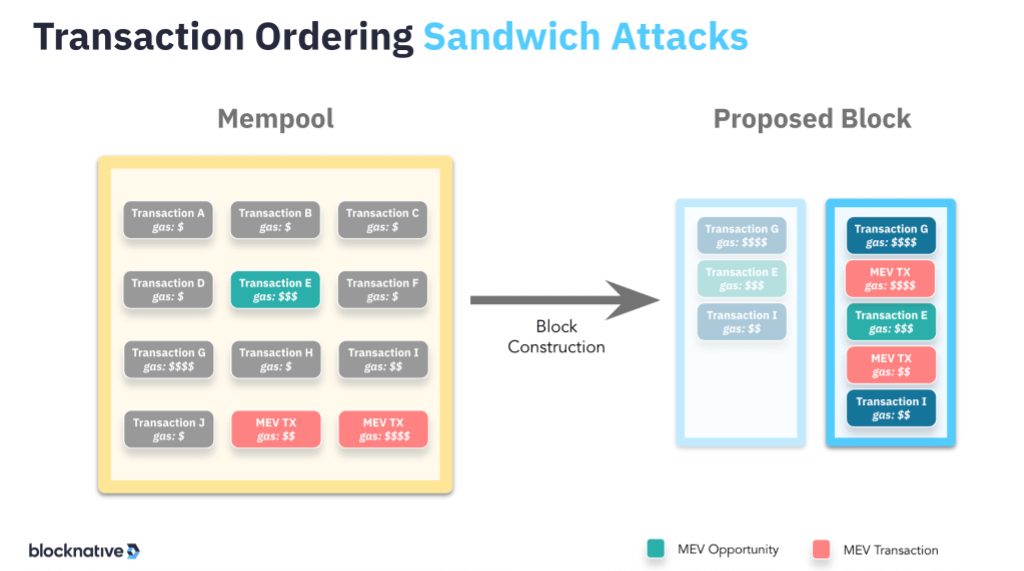

Web3 users could learn that they can use their collective voices to push validators toward more equitable outcomes. Currently, users accept that MEV is a necessary reality of interacting on-chain. If they are swapping on a DEX, there is a high probability someone is sandwich attacking them.

Sandwich Attack Diagram

The new standard of block building under PoS introduces the potential for blocks to be built that would exclude malicious types of MEV like sandwich attacks entirely. Some users may start to question why validators are choosing blocks that actively take advantage of them when there are other options available.

Aside from building blocks that protect users from MEV, there’s potential for blocks to be constructed that actively reward web3 participants. Since users are the originators of all MEV opportunities on the network, there’s an argument for returning some of this value to them. Blocknative CEO Matt Cutler outlined in his interview with Bankless that block building could even create a future where your wallet pays you to use it.

However, all of this is entirely dependent on the actions of validators. Will the community pressure them to choose blocks excluding certain types of MEV? Or will they select blocks that simply drive the most profit for themselves?

While exactly how these new incentives play out remains to be seen, it’s clear that the separation of block building from proposing catalyzes entirely new categories of economic actors with far-reaching implications and new, different, and perhaps even hidden power structures.

Perspectives on Regulatory Scrutiny

You may be skeptical about the idea that validators will act for the greater good. But the pressures to avoid certain types of MEV may not be strictly social. There’s a possibility that some validators will have legal considerations when proposing blocks.

Keep in mind that many Ethereum users do not run their own validators, and instead rely on centralized service providers to stake their ETH. Some of these staking services are offered by, naturally, the biggest crypto exchanges in the world like Coinbase, Kraken, and Binance.

These exchanges are regulated by traditional governmental organizations in ways that are far different from current mining operators. While a mining operator has no qualms about accepting a block under PoW that carries MEV based on front-running, there’s a very real question about a validator being operated by Coinbase, for example, wanting to propose a block that features blatant front-running.

As the Bank of International Settlements recently discussed in their paper Miners as intermediaries: extractable value and market manipulation in crypto and DeFi:

“Regulatory bodies around the world need to establish whether value extraction by miners constitutes illegal activity. In most jurisdictions, activities such as front-running are considered illegal. In traditional markets, regulated intermediaries must process trades in the best interest of the client, in line with best execution rules...There are several open questions on whether current regulation on insider trading is directly transferable to MEV. In most jurisdictions, the legal status of these actions is ambiguous. To provide clarity, legal research would have to assess whether the activities permitted by the Ethereum protocol and other DeFi ecosystems should actually be prohibited.”

Heavily-regulated crypto exchanges will need to carefully consider all the potential risks of the types of MEV their validators propose. Depending on their choices, the MEV landscape under PoS could shift dramatically compared to the world of MEV under PoW Ethereum which was driven almost entirely by the personal profit preferences of miners and searchers.

Fixed Block Times

Beyond the financial, social, and legal game theory that is impacting post-Merge MEV, there’s also an important technical change to consider in how MEV is produced in the first place.

The fundamental mechanisms behind how transactions are ordered on PoS did not change. This is because Ethereum is still utilizing the same execution client (Eth1) that was under PoW. However, the timing of how blocks are constructed has changed drastically.

PoW used variable block times, which meant that blocks could be confirmed at any moment. Every millisecond was equally ‘valuable' to MEV searchers. Network actors could not predict exactly when the next block would be confirmed.

Under PoS, blocks are now confirmed every 12 seconds in periods called “slots”. This means every millisecond is no longer equal to every other millisecond as those closer to the block proposal time hold more value for specific trading strategies.

There are tighter time horizons for various automated MEV strategies, creating competition for lower latency infrastructure. This will most likely have an impact on ETH gas fees, but enough data has not been gathered to make a full conclusion yet.

MEV searchers also now know up to 6m 40s in advance which validator will be proposing upcoming blocks. The implication of this is that new forms of MEV that focus on long-term strategy are possible.

This foresight happens because every 32 slots make up a period called an “epoch”. At the start of every epoch, the specific validators that will be proposing blocks for each slot are identified. Network users can then plan to structure their transactions based on the exact validators they know will soon be in charge of proposing a block.

This is an especially interesting aspect of MEV post-merge when combined with the potential for certain validators to avoid particular types of MEV. If a searcher knows that Coinbase will soon be a validator, they can avoid executing a strategy that would otherwise be profitable during a certain slot due to the fact they know that Coinbase is unlikely to choose their transaction.

Because MEV is focused on the specific ordering of transactions over time, there’s no doubt that the economic implications of fixed block times have created many ripple effects. This will be one of the most interesting subplots to continue to monitor following The Merge.

Build With Blocknative

MEV and block building are some of the most important aspects of Ethereum’s pre-chain layer and Blocknative is an active participant. We operate an MEV relay, block builders, and allow MEV searchers to submit bundles via our RPC endpoint. For network actors looking to help build the network, we feature a suite of web3 developer tools that allow you to integrate pre-chain data.

Accurate ETH gas fee estimation will help your users make it on-chain without anxiety and our real-time ETH Gas API can ensure your users always know how to price their transactions.

Our Mempool API and visual Mempool Explorer make it simple to monitor transactions and watch for any MEV-related risks that arise. Create your free Mempool Explorer account today and start prototyping your builds. We encourage interested builders and traders to join our Discord Community where you can connect directly with our team if you have any questions or feature requests. Or contact us directly. Blocknative is here to help you thrive in a post-Merge world.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension