Since the explosion of DeFi in the summer of 2020, MEV (Maximal Extractable Value) has continued to grow as a force in the Ethereum ecosystem. Toxic forms of MEV—such as frontrunning and sandwiches—can result in negative settlements for the transaction originators targeted by MEV bots. More neutral forms of MEV—like backrunning—have no impact on the transaction originator while still generating significant MEV profit. And more benevolent forms of MEV—like arbitrage—are necessary for the health of the ecosystem by balancing differences in asset prices across DeFi platforms.

There are many layers of complexity underlying how MEV works, the actors that are involved, and how it impacts the economics of Ethereum. While only toxic MEV can result in negative transaction settlement, all forms of MEV pose a risk to validator centralization. Currently, most of the profits from MEV transactions flow down to the validator. The more validators one has, the higher the chance of proposing a block containing extremely high-value MEV. As a result, more and more validators are likely to pool together to maximize their chance of earning these high-value blocks.

This begs the question: how does the ecosystem best mitigate the negative externalities posed by MEV while preserving the positive?

This blog explores the benefits, tradeoffs, and implantation issues of the different paths currently being explored for the future of MEV in the Ethereum ecosystem: MEV smoothing, MEV burning, and MEV sharing. The strategies outlined here are largely theoretical at the moment; further research and testing will be needed before any specific strategies are committed to official Ethereum development paths.

Why MEV is important to the future of Ethereum

While MEV and transaction ordering isn’t new or specific to web3, it has a higher level of visibility and, therefore, scrutiny as it relates to public blockchain networks. The opportunity for profit extraction in MEV is significant, with over $7 million in profit extracted in the last 30 days according to Eigenphi data—with about 78% of that being profit from sandwiched transactions.

Not only is MEV profit extraction a growing industry, it is a growing industry that is now intertwined with the economics of Ethereum staking. The Ethereum Merge ushered in an era of proto-PBS (proposer/builder separation) on the network via a protocol sidecar known as MEV-Boost. This allows network validators to outsource block production to specialists known as “block builders”.

Blocks sourced via MEV-Boost are extremely lucrative to validators. Based on median historic reward data, validator block rewards without MEV-Boost rewards total roughly .024 ETH. On the other hand, blocks with MEV-Boost rewards total roughly .064 ETH—a 2.6X increase. Since a single validator proposes roughly 5 blocks per year, this can significantly improve the ROI for an individual validator.

With the clear economic incentive of improved rewards, validators have adopted MEV-Boost en-masse. MEV-Boost is responsible for roughly 90% of blocks on any given day. But, while the improved ROI for validation incentivizes the network actors that secure Ethereum, there are externalities to the current MEV lifecycle.

There are a variety of methods being proposed to tackle this goal. Currently, discussions within the Ethereum development community center around options regarding the burning, smoothing, or sharing of MEV. They all involve novel designs that eliminate the variability in block rewards caused by the inclusion of MEV. Doing so would lead to more equitable block rewards, reducing the potential for validator centralization.

What will happen to MEV rewards in the future?

TLDR: There are currently three main paths being explored for the future of MEV on Ethereum: burning, smoothing, and sharing. Burning and smoothing target the centralizing potential MEV can have on validators by either removing the economic incentives of MEV for validators altogether (burning) or by distributing the value of MEV evenly throughout the pool of active validators (smoothing) rather than to the single current proposing validator. MEV sharing, on the other hand, targets the redistribution of MEV back to the transaction originators rather than being burned or flowing downhill to validators. MEV sharing is also the only current solution to tackle the negative externalities of toxic forms of MEV such as sandwiches through order flow auctions (OFAs).

MEV Burning

The idea behind MEV burning is straightforward: Instead of having to deal with certain centralized actors reaping the outsized rewards from MEV, the network would put in place mechanisms to burn the MEV that would otherwise be collected. The idea was originally proposed by Ethereum researcher Domothy on the ethresear.ch forum.

This proposal recommends implementing an auction for the “right to build a block” on the network. The auction would happen at the validator level. Instead of a single validator being selected to propose each block for each slot (the current configuration), this proposal would make it so that there are a select few validators that are all eligible to propose each slot. Which validator completes the task would then be selected based on auctioning off the “right to build a block”.

The theory presented in the original post is that each validator that is part of the proposal group will likely be willing to bid up to the amount of MEV reward included in the block for the right to propose the next block. This would result in the majority of the MEV being burned and validators only capturing the more consistent consensus and execution rewards for each block.

Discussions around MEV burning are still in their early research stages. The conversation has primarily centered around the ethresear.ch forum post, and an array of prominent community members have weighed in with their feedback.

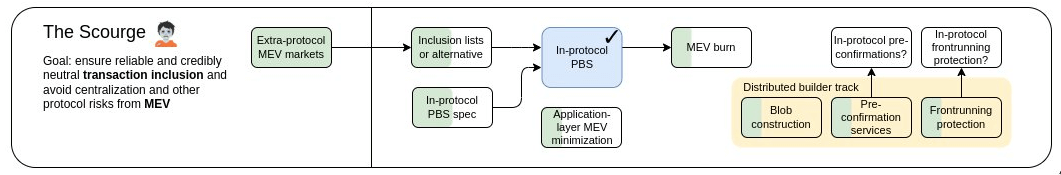

While the methodology outlined in domothy’s original post may not end up being the preferred method of MEV mitigation, it is worth mentioning that the official visual Ethereum roadmap does mark “MEV burn” as a goal within the “Scourge” development path focusing on MEV:

Our interpretation, however, is that this directive should be taken as a sign that some sort of “MEV burning” (or a related tactic like MEV smoothing or sharing) should be put in place to mitigate the centralizing effects MEV has on validators. It is likely not an indication that a specific MEV burning proposal is on track to be included within the protocol.

Implementing any MEV burning proposal within the protocol itself would likely be a significant lift in terms of development resources. The ethresearch.ch forum proposal outlines significant changes to both the execution and consensus layers of Ethereum, with arguably the most significant change being an increase of the network’s slot times from 12 seconds to 16 seconds to allow for the period of bidding on block proposal rights. Testing and implementing changes such as this would likely have to take place over multiple years.

While there are no examples of MEV burning in the wild today, the design of current MEV burning proposals is inspired by the burn mechanism found within EIP-1559, where the Base Fee for transactions is determined by the network and subsequently burned. This should theoretically support ETH’s Ultrasound Money thesis by contributing to the reduction of the overall ETH supply.

Further reading on MEV burning:

- https://ethresear.ch/t/burning-mev-through-block-proposer-auctions/14029

- https://twitter.com/domothy/status/1585333597019705345

- https://collective.flashbots.net/t/to-burn-or-not/647

- https://hackmd.io/@dmarz/notes-on-burning-mev

MEV Smoothing

MEV smoothing is another proposed mechanism for mitigating the variability of block rewards that include MEV opportunities. The most popular discussion of this topic can be found on the ethresear.ch forum. Author, Ethereum researcher Francesco, describes the proposal as such:

“Smoothing MEV means reducing the variance in the MEV that is captured by each validator, with the ultimate goal of getting the distribution of rewards for each validator to be as close as possible to uniform: a staker would then get a share of rewards proportional to their stake, just like with issuance.”

In a longer piece linked within the post Francesco reasons that this is necessary to battle centralization, consensus instability, and a weakened overall contribution to security caused by the current unpredictability of MEV rewards.

The post argues in favor of a committee-driven approach to MEV smoothing where the proposer still receives some percentage of MEV rewards, but the rest is distributed amongst a committee of validators. Franceso describes the technical details in this manner:

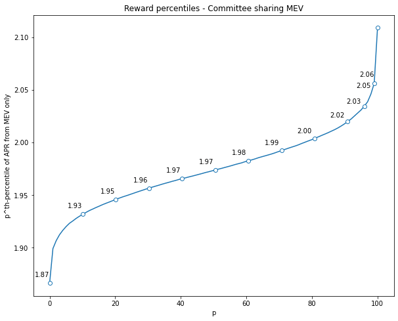

“A validator gets assigned to one committee per epoch, and gets 1/6250 of the FlashBots bundles’ rewards for the corresponding block, if any. The proposed scheme leads to a fairly equitable distribution of rewards: the most unlucky get about 11% less than the luckiest, and most of the mass is concentrated in a much smaller range.”

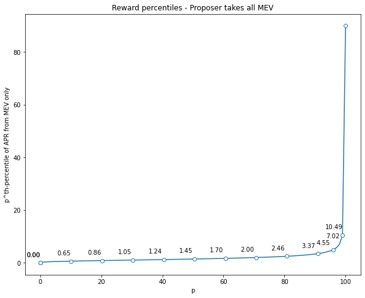

The visuals included in the longer breakdown of this idea make the power of this proposal abundantly clear. Here you can see the estimated reward percentiles under the current market for validator MEV capture. The luckiest validators in the market outperform the majority of validators with 70% of all validators earning less than the mean:

Under an MEV smoothing structure, the rewards distribution would likely be much more predictable and fairly distributed:

Adding MEV smoothing as proposed above would require an update to Ethereum’s attestation and fork choice rules. Similar to the timeline for any proposed MEV burning initiatives, enshrining these rule changes within the protocol would likely take years.

It is also clear from the current state of discussion and research around the topic that burning vs smoothing is not a clear-cut binary choice. The possibility of having a percentage of MEV burned within a smoothing scheme is also under consideration. Francesco presents this as an option within the original post, but has also made clear that doing so may not be ideal:

I am a bit skeptical about burning: for example, you could take MEV smoothing and turn it into MEV burning, or at least apply some tax, but that would weaken the incentive-compatibility of the whole scheme and maybe result neither in smoothing nor burning

— Francesco (@fradamt) September 6, 2021

This is not a universal view, however, and others have stated that the two ideas could live side-by-side:

burning some of the mev is likely the closest we can get to using mev for public goods while still maintaining credible neutrality

— stokes (@ralexstokes) October 10, 2022

There are also discussions around Ethereum staking middleware such as the restaking protocol EigenLayer to be used in future smoothing implementations:

Stakers restaking with @eigenlayer could opt into MEV smoothing protocols where they agree to take the highest bid on a public process as proposed by a majority of restakers. If a majority are not malicious, then off chain deals are not possible.

— Sreeram Kannan (@sreeramkannan) August 22, 2022

While smoothing is not available as an in-protocol Ethereum function, the general principle can be seen in practice via smoothing liquid staking pools. Anyone who participates in Ethereum’s largest staking pools, Lido and Coinbase, will have their rewards smoothed so that they receive an average of the rewards made by all validators operated under their respective umbrellas (minus staking operator fees). Rocket Pool also operates a voluntary smoothing pool that any minipool node operator can choose to participate in.

Further reading on MEV smoothing:

- https://ethresear.ch/t/committee-driven-mev-smoothing/10408/6

- https://hackmd.io/@flashbots/mev-in-eth2

- https://twitter.com/tarunchitra/status/1560323691258552323

- https://twitter.com/ralexstokes/status/1579516871120138240

- https://notes.ethereum.org/cA3EzpNvRBStk1JFLzW8qg

- https://ethereum.github.io/beaconrunner/notebooks/naiveurn.html

- https://notes.ethereum.org/@fradamt/B18AGRk-Y

MEV Sharing

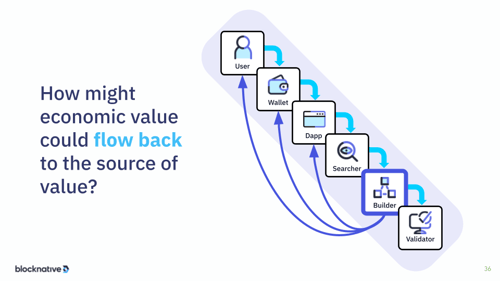

While MEV smoothing/burning focuses on the end of the MEV supply chain and interactions between block builders and validators, there are other proposed paths to minimize the variability of MEV that are being researched toward the beginning of the supply chain. This is generally called “MEV sharing”.

The first high-profile discussion of the topic occurred when Blocknative CEO Matt Cutler appeared on the Bankless podcast to discuss The Merge:

Start video embed at 1:08:35

We highly recommend watching the full video for context, but for the sake of brevity the most important quote is included below outlining how MEV sharing is made possible by PBS:

“There's a user, there's a wallet, there’s a dapp, there's a protocol, all of which you could sort of look at and say ‘these are the sources of transactions of which MEV results’...Wouldn't it be a more level playing field if they were to participate in this as well?...So now you can have block builders that provide rebates. I always like to say imagine instead of you having a wallet that you add money to pay for your gas fees, your wallet pays your user…One might imagine different wallets with different techniques (for) how much they capture versus how much to share. And then users now have all sorts of new possibilities to select which wallet provides the greatest rate of rebate.

(S)o if you're a dapp developer, you can participate in this. If you are a wallet developer, you can participate in this. If you're a protocol, you can potentially participate in this as well. And so now as a block builder, you have the opportunity to take that (into consideration for) blocks. And instead of just giving (MEV) all to the validator, you can say ‘I want to share some of it with the user’.”

Post-Merge, this concept has continued to evolve with numerous ideas currently in discussion regarding the best way to share MEV amongst the various members of the supply chain. Here at Blocknative, we have introduced a proposal known as Wallet-Boost which would help end-users take control of outcomes and participate in the MEV market.

Watch Blocknative CEO Matt Cutler present Wallet-Boost at ETHDenver

In contrast to the in-protocol work that would need to be completed for MEV smoothing or burning, the MEV sharing features of Wallet-Boost are available now for implementation between wallets and MEV searchers.

The MEV research collective Flashbots has also introduced a proposal for programmable private orderflow that rewards users. Their project, MEV-Share, would complete this via a matchmaking protocol between users and searchers.

For a deep technical overview of the current design space, we highly recommend the recent presentation from 0x Labs data scientist Danning Sui at ETHGlobal. Danning covers how the MEV sharing workflow looks in practice, the current market for MEV revenue between searchers/builders/validators, and where surplus value can be found within the MEV supply chain to be returned to users:

Further reading on MEV sharing:

- https://hackmd.io/@blocknative/ByDWGiTjs

- https://github.com/blocknative/discourse/discussions/1

- https://collective.flashbots.net/t/mev-share-programmably-private-orderflow-to-share-mev-with-users/1264

- https://frontier.tech/the-orderflow-auction-design-space

- https://blockcrunch.substack.com/p/is-flashbots-a-bad-business-the-flashy

Be a part of the future of MEV

In the past, Blocknative helped the Ethereum community adapt to upgrades such as EIP-1559 and the proto-PBS ecosystem put in place by The Merge. We look forward to continuing to support the Ethereum development roadmap process and tackling the problem of The Scourge.

Validators can earn more by connecting MEV-Boost to the Blocknative Relay endpoint. Connect to our relay today to maximize your block rewards. If you’re a dapp or wallet interested in #ShareTheMEV and Wallet-Boost, we would love to chat with you.

You can always join our Discord community for direct access to Blocknative employees. Or follow us on Twitter @Blocknative for the latest updates from our team.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension