Gas impacts every Ethereum participant, and estimating a competitive gas price alongside market volatility is a complex task. This challenge is particularly evident under periods of extreme market volatility — such as Black Thursday in 2020 and the crypto crash in May of 2021

As we have previously explored, the mempool acts as a competitive gas fee marketplace because miners are incentivized to include – that is, confirm – transactions with the highest gas price. Understanding how the mempool impacts the gas market will help you to accurately set fees and transact with confidence.

In response to the constantly changing mempool competition, we launched our ETH gas API to provide everyone in the Ethereum ecosystem with a new level of understanding and precision when setting gas prices. Our goal is to make mempool data accessible and easy to incorporate into Dapps, protocols, web3 wallets, and trading strategies.

Read on to learn how Gas Platform works and how it compares to other ETH gas estimators.

How Blocknative Gas Platform works

Gas Platform leverages Blocknative's real-time global mempool data platform to inspect all public pending Ethereum transactions. With this real-time data, Gas Platform can accurately predict the minimum ETH gas price required for next-block confirmation.

Specifically, Blocknative Gas Platform:

- Leverages our global node network for a comprehensive view of transaction activity.

- Uses an advanced machine learning model to accurately predict gas prices.

- Makes predictions based on block number rather than time.

- Provides gas estimation confidence levels, giving you and your users precise control over transaction fees.

- Provides an easy-to-integrate API that is fully documented and actively supported.

- Has an easy to use front-end ETH gas fee tracker to make our Gas Platform results more accessible to everyone.

- Integrates with Mempool Explorer so you can keep a pulse on gas fees.

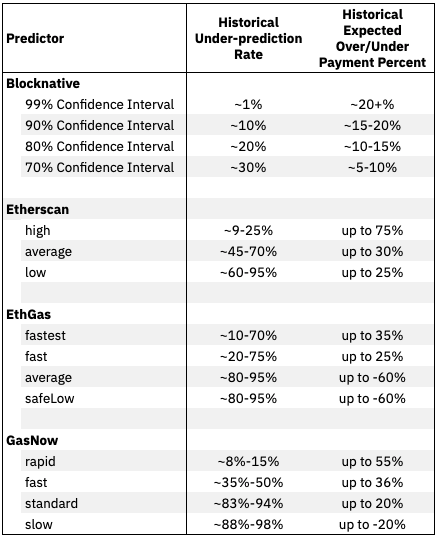

In order to understand how Gas Platform differs from other gas oracles, you need to understand two factors:

- Under-prediction rate — the measure of how often a predicted gas price is under the actual minimum gas price included in the block. Or in other words, how often a gas price is too cheap, thus causing your transaction to miss the next block.

- Expected overpayment percent — the difference between the predicted gas price and the actual minimum gas price divided by the actual minimum gas price. In other words, how far away – either under or over – a predicted gas price is from the actual minimum gas price.

When you use Blocknative Gas Platform, it can be helpful to think of the confidence level as the under-prediction rate. For example, our 70% confidence level means the predicted ETH gas price will be under the actual minimum price about 30% of the time. Therefore, consistently using the 70% confidence level will result in your transaction being included in the next block 70% of time and missing the next block 30% of the time.

The below graph shows an excerpt of our confidence interval gas predictions compared to the actual minimum gas price. This helps develop a visual intuition for each confidence interval and its relationship to the actual minimum ETH gas price.

.png?width=806&name=image%20(1).png)

How Gas Platform's Confidence Intervals Compare To The Minimum Gas Price

Setting an ETH gas price requires a tradeoff between the under-prediction rate and the expected overpayment percent. This is a classic Goldilocks problem: you want to set your gas fee high enough to get into the next block without overpaying.

Sophisticated users know sometimes it is better to be safe than sorry, like when you absolutely must get a given transaction into the next block — and are willing to overpay to ensure that is the case.

How does Blocknative Gas Platform compare?

We often get asked how to compare Blocknative Gas Platform to other ETH gas estimators. This is requires comparing our confidence levels with their time intervals — slow, medium, fast, and fastest.

To compare Blocknative Gas Platform to ETH gas estimators, we calculated the overpayment percent at different confidence levels over hundreds of thousands of blocks. By using our archival historical mempool data, we compared Blocknative Gas Platform to Etherscan, EthGas Station, and GasNow. See below for a summary table of our results.

Gas Platform Comparison from May-14-2021 12:39:42 AM +UTC to Jun-02-2021 12:18:03 AM +UTC.

As measured by consistency in getting into the next block, Blocknative's Gas Model outperformed all others. During the massive gas fee spikes on May 19, 2021, Gas Platform 99% confidence level did not miss a single block, while the 'fastest' gas price of other gas oracles results missed almost 70% of the blocks.

We constantly monitor the performance of Gas Platform so that we can actively refine our models and improve our predictions.

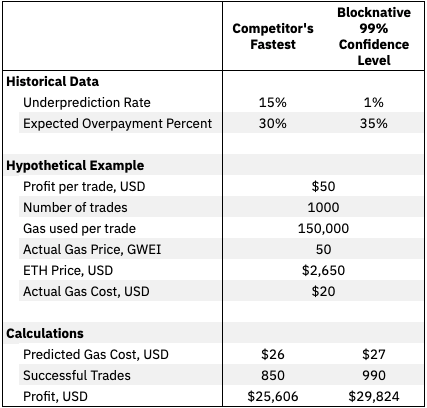

A tale of two traders — and their confidence

At a cursory glance, it might seem safe to assume that there would not be a huge difference in trader profitability and win rate when using gas fee at the 90% confidence level versus the 99% confidence level. But that would be a bad assumption! To help illustrate this, we created a high-level example of a trader’s profitability when using different gas fees at two confidence levels.

- Our data indicates that the 'fastest' quote from a typical gas fee oracle equates to the 90% confidence level.

- Gas Platform provides multiple confidence levels, including the 99% confidence level. On the surface, the 99% confidence level results in a higher gas price and hence may negatively impact profitability... but in return for a higher trade win rate.

- Generally, the incremental gas fee costs savings associated with the 90% confidence level is dwarfed by the reduced profitability associated with a lower win rate.

- In other words, a trader will typically be better off paying a little more – but not too much more – per trade in exchange for winning more trades.

In the above example, the trader who relies on the higher confidence level would realize more than $4,000 in profit for every 1,000 trades.

Go hands-on with Blocknative Gas Platform today

Blocknative's Gas Platform is available to all builders and traders as an ETH gas API, via our ETH Gas Estimator, or in Mempool Explorer. Gas estimations are available at different confidence levels so you can make informed decisions when transacting on-chain. You can view gas data for both Legacy (type 0) and EIP-1559 (type 2) transactions.

To learn more, watch our Blocknative Gas Platform Quickstart for a short overview:

As with everything we build, we are just getting started. We have a rich roadmap for Gas Platform. And our data science team is constantly refining our models to provide traders and builders with ever-more precise and flexible confidence when working with ETH gas.

And when you are ready to take your gas game to the next level, you can upgrade to a commercial plan to get faster real-time updates on the Ethereum gas fee marketplace powered by our mempool API:

Please join our Discord Community to connect directly with our team and ask specific questions or make feature requests.

Additional notes:

- Our team includes a number of active DeFi traders, each of whom have found Gas Platform to be an indispensable component of their trading strategies. You can connect with our team in the Blocknative Discord Community.

- Blocknative's Mempool API now includes estimatedBlocksUntilConfirmed in pending payloads, which is powered by Gas Platform. This field will only be shown when the estimate is 5 blocks or less. You can see this in action by monitoring all pending Uniswap trades on Mempool Explorer.

-

Today, not all pending transactions are publicly broadcast to the Ethereum network. These 'dark pool' transactions occupy block space and can adversely impact the probability of other pending transactions to successfully get on-chain in a timely, predictable fashion. Our platform has long collected data describing such Miner Extractable Value. We may publish or productize this data in the future.

Gas Extension

Blocknative's proven & powerful Gas API is available in a browser extension to help you quickly and accurately price transactions on 20+ chains.

Download the Extension